Many investors ask how an investment in logistics will look. You need to understand the market and learn a lot about company health. It is also crucial to oversee many aspects that shape investment opportunities.

It is pretty interesting to look into the numbers prepared by McKinsey. Their research states that over the last several years, there has been a massive shift in company investment. Recently, as of 2023, over 43% of investment was placed into U.S. market logistics startups, 19% into Indian startups, where we saw an increase of almost 10%, and a massive drop in Europe, where over 16% less investment was considered in this market.

Considering this, we can see where startups should seek support from angel investors. This gives an overview of where to go to search for funds. However, it should be essential for many to understand that this is also connected to the economic situation and overall public funding.

For example, we may see a massive drop in investment in European tech startups in logistics. Still, this is also related to the considerable budget release for this sector from public money for notable investments. This is how simple it is.

So, join us on the journey and learn more about investing in the logistics industry and supply chain management. The article below provides more information for top logistics investors and global trade elements that are focused on young companies' aspects.

VCs on the move: top 10 investors backing the next gen of logistics and supply chains

Below is a list of 10 key investors in the US, MENA, and Europe that are shaping the logistics industry. These companies are strategically funding startups and technologies that are modernizing supply chains, transportation, and delivery systems, stages, from seed to growth stage, with a focus on sectors such as Climate Tech, Green Tech, Health Tech, and FinTech.

1. Activate Capital

USA | Series B - C | $10M - $30M

US-based Activate Capital is focused on accelerating the transition to a sustainable and adaptive future by investing in companies developing breakthrough solutions in energy, industry, and transportation, including sectors such as agriculture, climate, energy, and supply chain management. Among the projects invested in are Crusoe Energy Systems, Enpal, Fictiv, Flexe, Generate Capital, and others.

Website: https://activatecap.com

2. Allied Venture Partners

Canada | Pre-Seed, Seed, Series A | $100K - $300K

Based in Canada, Allied Venture Partners is one of the largest angel networks in Western Canada, backing early-stage software and technology startups with a broad focus on diversifying the startup ecosystem in the region, including areas such as AI, SaaS, and fintech. Among the projects funded, the most significant are Ediphi, Trace, ROOK, League of Play, FreightFlows, and Autio.

Website: https://www.allied.vc

3. Almaz Capital

Germany | Seed, Series A | Varies

Almaz Capital is a US, UK, and European venture capital firm focused on investing in tech startups serving global markets, specializing in deep tech and B2B software, including AI, ML, and cybersecurity. Among the projects that are actively working now are Acronis, CarPrice, GridGain, Hover, Parallels, Petcube, and Yandex.

Website: https://almazcapital.com

4. HV Capital

Germany | Pre-Seed, Seed, Series A - F | $100K - $250M

HV Capital operates across Europe and is committed to supporting founders on their way to building impactful digital businesses. The company provides critical investments at all stages of growth, with a forward-looking focus on sectors such as climate tech, green tech, and ed tech. Among the projects are Quantum Systems with aerial drones, Sennder, a representative of the delivery service, and CarOnSale, which sells used cars.

Website: https://www.hvcapital.com

5. Index Ventures

Switzerland | Pre-Seed, Seed, Series A - F | $100K - $500M

With a strong presence in the US, UK, and Europe, Index Ventures actively invests in technology startups throughout their development, from initial concepts through to mature growth stages. The company is dedicated to fostering innovation in key areas such as climate tech, green tech, and health tech. Notable projects include Algolia and GetHarley.

Website: https://www.indexventures.com

6. Lowercase Capital

USA | Seed, Early-Stage | Varies

Lowercase Capital is rooted in the US and focuses its energy on supporting early-stage technology startups with disruptive ideas. Their investment portfolio often includes companies in social media, innovative software solutions, and transformative consumer internet services. The company has invested in some of the most famous projects of the last decades, including Twitter, Uber, Instagram, Twilio, Kickstarter, Stripe, and Blue Bottle Coffee.

Website: https://lowercasecapital.com

7. Maersk Growth

Denmark | Pre-Seed, Seed, Series A - B | $500К to $50M

Maersk Growth, headquartered in Europe, is the visionary corporate venture arm of A.P. Moller-Maersk. Their goal is to drive the future of supply chains by investing in technologies and start-ups that focus on digitalization, democratization, and, above all, decarbonization. Among the successful projects in the supply chain sector are Afresh, Fliit, Forto, Vertoro, and ZigZag.

Website: https://www.maersk.com/growth

8. Tiger Global Management

USA | Series A and Beyond | Varies

With a significant global presence spanning the US, UK, and Asia, Tiger Global takes a long-term investment perspective, backing leading public and private companies that benefit from technological innovation. The focus is on key sectors such as internet, software, consumer goods, and financial technology. The company has funded some of the most successful startups to date, including Facebook, LinkedIn, Spotify, Stripe, ByteDance, JD.com, Alibaba, and Flipkart.

Website: https://www.tigerglobal.com

9. UVC Partner

Germany | Seed, Series A | €500К - €30M

As one of the leading venture capital firms in Europe, UVC Partners strategically invests in B2B technology start-ups, providing not only the necessary funding but also valuable access to a robust network of corporate partners. Its investment strategy focuses on key sectors such as software, advanced manufacturing, and efficient logistics. Among the projects being financed are both startups and quite successful ones such as FlixBus, Isar Aerospace, planqc, Proxima Fusion, Reverion, Tacto, TWAICE, DeepDrive, and STABL.

Website: https://www.uvcpartners.com

10. 83North

Israel | Pre-Seed, Seed, Series A - C | $100K - $500К

The company has been operating for 19 years and believes in transparent processes for entrepreneurs. Their global investment reach across sectors in the US, Europe, and Israel is driven by referrals, resulting in a portfolio of 90 companies with 33 exits and 14 unicorns. They are ultimately seeking to partner with exceptional individuals driving innovation and technology to positively impact the world. Among the successful projects are AeroScout, Cappitech, Celonis, and Motork.

Website: https://www.83north.com

✅ Download the full list here

Logistics in flux: venture capitalists bet on clean supply chains

In 2022’s challenging logistics startup landscape, sustainable logistics stood out, attracting more investment despite the recession. While overall funding dropped, sustainable logistics startups saw a 12% funding increase, highlighting the rising importance of ESG (environmental, social, and governance) priorities. Notably, their share of total funding doubled from 16% to 36%, reflecting changing market demands and growing interest in ESG-aligned logistics operations.

Startups in last-mile delivery and warehousing secured much of this investment, likely due to their close interaction with eco-conscious consumers. As global sustainability regulations tighten, private equity firms are expected to expand their focus, backing B2B logistics solutions that emphasize sustainability. This shift offers major opportunities for firms to support innovation and accelerate the logistics sector’s transition to more environmentally and socially responsible practices.

Despite economic uncertainty, mergers and acquisitions in the T&L sector increased sharply in 2021. Based on PWC's Germany research, more than 322 deals (>$50 million) were announced, a record high. Although their relative share declined. The value of megadeals doubled, bringing the total value of deals to $219.1 billion. What does all this mean? It means that strategic investors increased their exposure. Freight deals dominated, with a 75/25 freight/passenger split. Significant logistics changes, including funding reversals or sustainable investments with a critical ESG priority, accompanied M&A. Nonetheless, investors still face serious problems today.

Here are some of the main issues:

Dramatic funding reversal in eCommerce

Following a record-breaking 2021, logistics startup funding plummeted nearly 50% in 2022. This shows a significant shift in investor sentiment due to macroeconomic pressures and eCommerce deceleration. This abrupt change highlights the sector's sensitivity to external economic forces.

Sustainable logistics surge

Amidst the overall funding downturn, sustainable logistics emerged as a beacon of growth, with funding increasing by 12%. The share of total funding allocated to sustainable business models more than doubled, demonstrating a powerful market shift towards ESG-aligned supply chains.

Second-half 2022 plunge

The funding decline intensified in the latter half of 2022, with a sharp drop in venture capital activity due to rising interest rates. This precipitous fall underscores the significant impact of monetary policy on logistics startup investments.

ESG-driven investment trends

Venture capital firms increasingly prioritize investments in logistics companies, demonstrating a strong commitment to environmental, social, and governance (ESG) principles. Growing consumer and regulatory demands for sustainable supply chain practices drive this trend.

Technology and adaptability

Investors are emphasizing technological innovation and market adaptability when evaluating logistics startups. Companies leveraging artificial intelligence, automation, and data analytics, coupled with the ability to navigate evolving market conditions, are attracting significant attention.

Need help with custom software development for your logistics business?

Learn how we can help you

Explore moreAs we mentioned above, the logistics sector is increasingly turning to cooperation and alliances for decarbonization to address the significant greenhouse gas emissions from transportation, which account for more than 16% globally and 25% in the EU. This shift is being driven by global initiatives, such as COP26 and the EU's Fit for 55 package. All that requires ambitious emissions reductions. So, to achieve these goals, companies start with strategies that include managing freight demand and using multimodal transport. It was all to increase energy efficiency and adopt low-carbon energy sources.

It resulted in significant investments in robust and sustainable infrastructure. This included, among other things, the development of electric vehicle charging networks, the expansion of high-speed rail lines, and the creation of new railway hubs for containers, such as Venlo in the Netherlands. Smart infrastructure also includes many digital technologies for traffic management and logistics optimization. All of this was essential to maximize efficiency and minimize emissions.

Here are key points regarding decarbonization and infrastructure investment:

Global emission reduction goals. Transport accounts for over 16% of global greenhouse gas emissions, driving pressure for decarbonization.

Collaborative decarbonization. A rise in sustainability-related collaborations and alliances between logistics, OEMs, infrastructure, and energy players.

Nearshoring as a strategy. Utilizing nearshoring to reduce transportation distances and carbon footprints, influenced by pandemic disruptions and decarbonization pledges.

Multimodal transport and shared assets. Emphasizing smart utilization of multimodal transport and shared fleets/assets for efficiency.

Investment in low-emission infrastructure. Increased investment potential in infrastructure supporting energy-efficient fleets and low-emission energy sources.

Superplayers rise: strategic M&A reshaping global logistics investments

The freight transportation and logistics sector has witnessed a surge in strategic mergers and acquisitions. This was led by large shipping companies such as Maersk, MSC, and CMA CGM. These companies sought to integrate vertically, taking on targets across the supply chain management, from port terminals and freight forwarders to contract logistics and eСommerce fulfillment.

PCW Germany has observed that this trend was not limited to global giants; there was significant consolidation in China through local deals and the creation of the state-backed China Logistics Group. Moreover, Africa has also emerged as a key region. This attracted significant investment through multibillion-dollar deals by DP World, Hapag Lloyd, and CMA CGM. So, it shows that colossal capital went with growing interest from companies such as Kuehne+Nagel and Maersk.

Let's look at the main features:

Vertical integration. Major players are expanding their control across the supply chain.

Global expansion. Strategic investments in emerging markets like Africa and consolidation in China.

ECommerce logistics. Acquisitions to strengthen eCommerce fulfillment and contract logistics capabilities.

Consolidation. The formation of larger, integrated logistics entities.

Strategic investments. High-value deals show a huge investment in the logistics sector.

Investing in logistics in 2026: key considerations

The logistics sector has experienced a dramatic shift in financing, which may reflect broader economic trends. After peaking in 2021, investment in new logistics ventures plummeted by nearly 50% in 2022, with the most severe decline occurring in the second half of the year. This decline was visible along with rising interest rates, which previously significantly slowed venture capital activity.

We may say that this is a slowdown. It was driven by a problematic macroeconomic climate and a slowdown in eСommerce growth, highlighting the sector's sensitivity to external economic pressures in McKinsey's analysis of 600 logistics startups. Their research represents more than $90 billion in funding, which reveals a market undergoing significant recalibration. While the 2021 boom highlighted the sector's potential, we observed 2022 as a much more significant slowdown that calls for a more cautious and strategic approach to investment.

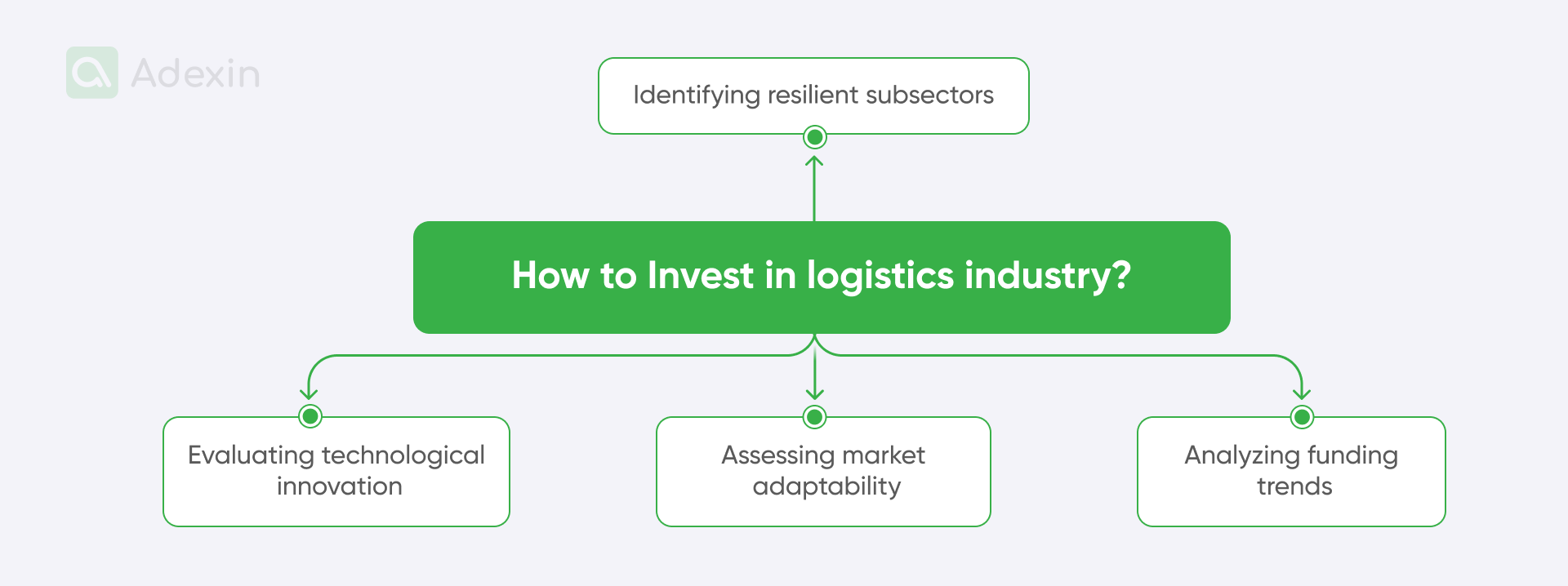

Navigating the current logistics investment landscape requires a nuanced approach. So, you have to look at what it's all about. Given the sector's recent ongoing market volatility and shifting dynamics, you should do so. Investors should focus on:

Identifying resilient sub-sectors. Prioritize companies with strong fundamentals in areas less susceptible to macroeconomic fluctuations.

Evaluating technological innovation. Look for startups leveraging AI, automation, and data analytics to drive efficiency and address key industry challenges.

Assessing market adaptability. Consider companies that demonstrate agility and the ability to pivot in response to changing market conditions.

Analyzing funding trends. Attention to venture capital activity closely and funding shifts within specific logistics subsectors.

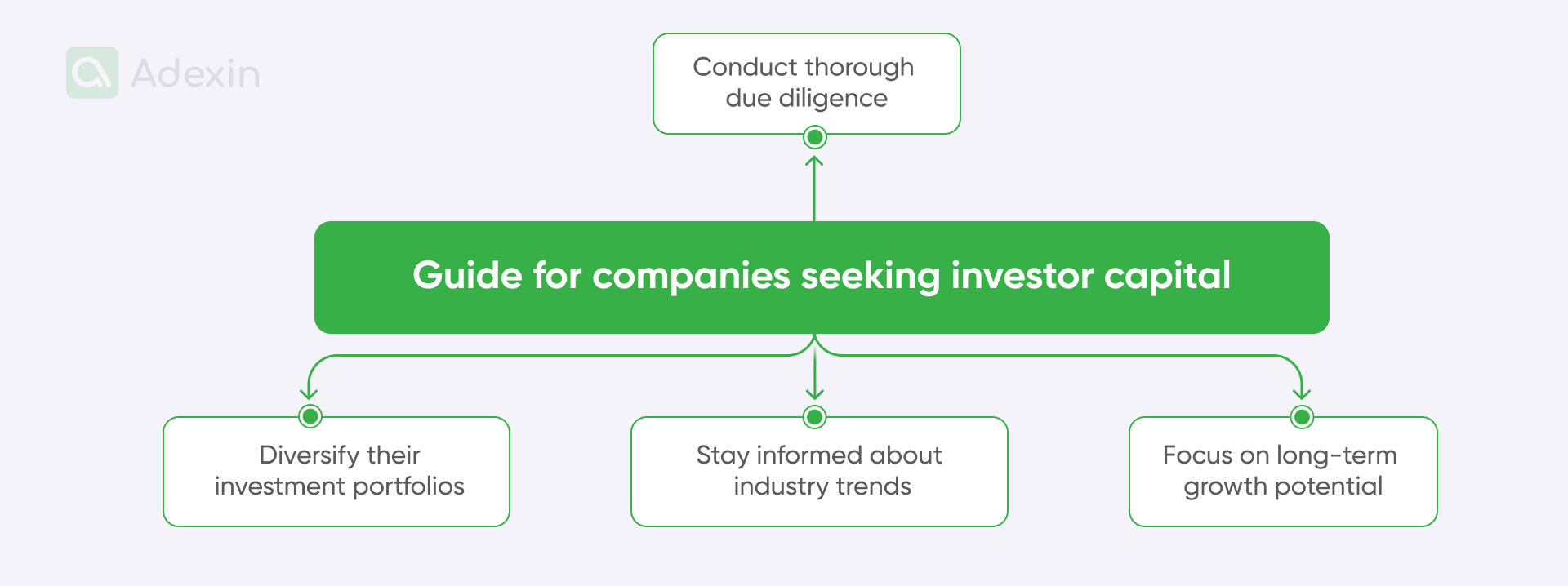

This provides a guide for companies seeking investor capital. But as a startup, each logistics company should know that investors will do the following:

Conduct thorough due diligence. Investors will assess the company's business model, competitive landscape, and financial health.

Focus on long-term growth potential. They prioritize investments in companies with sustainable business models and clear paths to profitability.

See if you can diversify their investment portfolios. Investors aim to mitigate risk by investing in various logistics companies across different subsectors and regions. So, you need to offer cutting-edge solutions or stand out.

Seek to stay informed about industry trends. They want to keep abreast of emerging technologies, regulatory changes, and economic factors that may impact the logistics sector.

Finale takeaway

The logistics investment landscape is dynamic and influenced by global economic trends. This all involves technological advancements and increasing sustainability demands. Since 2021, we have seen a peak in logistics startup funding, which has continued until now. However, there was some periodic dropdown, with a decline in 2022 due to macroeconomic pressures and shifting investor sentiment. Amidst this volatility, strategic opportunities remain for investors who adopt a nuanced and informed approach.

Investors must navigate a complex and evolving landscape, focusing on resilient subsectors, technological innovation, and sustainable practices. The shift towards sustainable logistics and the ongoing sector digitalization present significant opportunities for investors and companies alike.

Continuously monitoring global economic trends, regulatory changes, and technological advancements impacting the supply chain and logistics sector. Download the list of 100+ logistics investors to expand your network and identify potential funding sources. Are you a logistics startup seeking to grow? Contact us today for a consultation and explore potential growth opportunities with cutting-edge custom-made software.

Are you in search of a reliable tech partner?

Adexin can help with advanced logistics solutions

Contact us