Customs plays a significant role in ensuring safety and security for international trade. Custom duties contribute significantly to the national budgets of the US, the EU, and its Member States. Therefore, all operations are under the scrutiny of domestic economies.

Globalization has been ongoing for many decades, so there is a growing need for fast and reliable interconnectivity among nations. Countries worldwide have opened up more to the customs business, fostering collaboration to establish trusted networks. With increasing volumes of international trade and new business models, customs administrations face a growing exposure to dangerous documentation mistakes, fraud, and increasing security threats.

The rapid change in the business landscape requires customs transformation and improved risk management. The solution to these problems comes with integrating customs operations with IT technology.

Managing declarations and customs documents flow

Customs operations face numerous challenges today. Despite that, custom administrators from transportation, logistics, and supply chain industries can access diverse data sources. There is still a need for higher precautions towards the following business areas in customs:

More effective oversight of cargo on complex end-to-end trade lanes.

Much more effective risk assessment across different trade models.

Focus on building trusted networks.

These three elements remain the highest challenges for customs operations in general. It isn't easy to align global approaches and unify all the networks to simplify all side and core processes. The need for the proper methods in the areas above is a root cause of delivery delays like in e-commerce. It is evident when e-commerce companies face high volumes of items often blocked by customs law regulations in warehouses awaiting documents for clearance.

This aspect also refers to cargo that might be crucial for global economies, which may significantly impact the country's development and economic prosperity. In this case, we can refer to import goods manufactured in China to the EU. Companies from China are required to supply customs declarations that specifications may not align with UE country's standards.

Smoothness in processing the custom operations is highly dependent on the seamless document flow. The extensive scale of all documents depends on the law standards and regulations for trading. The various preferences and national requirements make work for administrators in freight forwarding and customs very difficult.

Customs documents case study

Reducing administrative burden in customs control and declarations is a process that takes time. Even in some highly developed European countries, law regulation changes are also moving slowly or not moving at all. Because every customs administration has its preferences and national requirements, keeping up with flexibility is a crucial principle. The taxation methodology is also highly intricate, and, as seen in Belgium, it undergoes changes on an annual basis.

Using the legislation of customs law in Belgium as a case study, we can emphasize an example given by attorney-at-law Ward Lietaert from Customs Legal BV, registered in Antwerp. During a live presentation at the Transport & Logistics 2023 fair in Antwerp, we heard from him about exceptional hurdles in handling the customs process for shipments from Taiwan to the EU.

He described the case of a Taiwanese company that imported goods, such as solar panels from China, dedicated for export to the EU. The company didn't indicate the country of origin of the goods in the documents. Some goods were on the EU import restriction lists when the process was handled. The source of the goods was investigated in the EU upon arrival, and the Taiwanese company was prosecuted to pay a fine of about 8,170,000 EUR for not following customs law regulations.

Nevertheless, through the intervention of the attorney-at-law from Antwerp and his support in the process, the Taiwanese company could avoid paying the fine. This case shows that overlooking essential documents can be very painful for business but also highlights the vital role of supporting attorney-at-law.

The root cause of such cases can vary. Sometimes, it is a fraud, but sometimes it is just overlooking the proper documents. This is because customs administrations are heavily dependent on centric regulated operations, which are based on country-centric processing patterns. There needs to be better document management in place, as well as better insight and data updates on law regulations.

Customs document management

This case study from Belgium reflects the real-life example that customs processes are dependent on document management and document workflow. Lack of attention to these processes can result in expensive fines. Therefore, the solution can be a custom document management system that enables customs administrations and freight forwarders to shift operations away from today's regulation-centric approach.

Document management systems can include a built-in function for receiving custom declarations, validating declarations, risk assessment, determining custom debts up to the moment when your custom clearance can be performed, and safety from penalties and release to the foreign market.

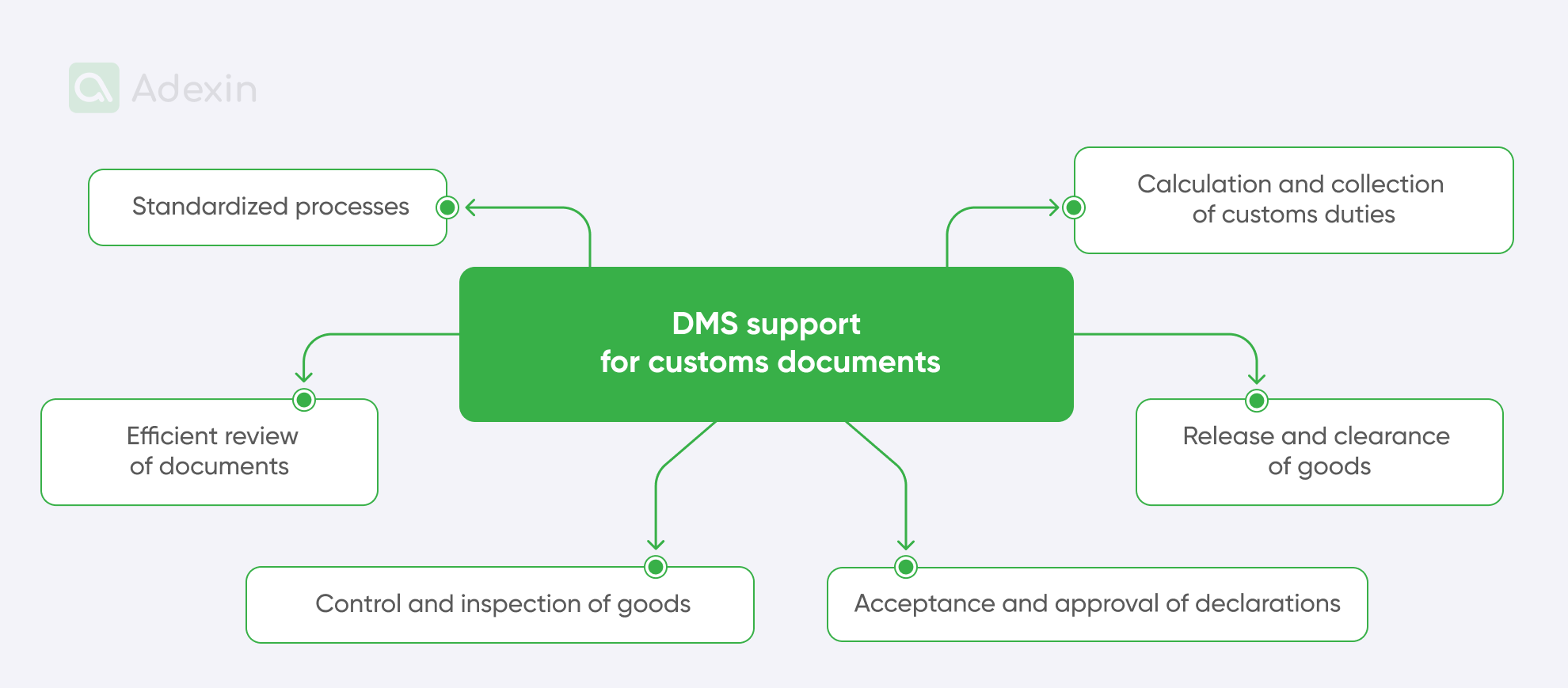

Here is where DMS for customs documents can support customs operations:

Standardized processes

Acceptance and approval of declarations

Control and inspection of goods

Calculation and collection of customs duties

Release and clearance of goods

Efficient review of documents with scanning

These cases must highlight that inside the DMS software, you'll be able to create various document workflows, as, for example, our team did for eTEU, offering an excellent blockchain-based system. When we're talking about document workflows in customs, based on country law regulations, you may need to put in place additional steps for document evaluation or approval. This flexibility should be a built-in function in your DMS software for customs. Moreover, in many cases, the DMS system can connect directly via API with customs offices, saving your people time from endless email communication and embedding PDF document copies into emails.

Need help with document management systems development?

Learn how we can boost your business processes

Explore moreFinal takeaway

As it was said in the headline of the attorney-in-law presentation in Antwerp: 'Customs Compliance or Conviction?' companies can make a choice between being more successful by following the law in their international trade. What is more important, they can save time and money on costly mistakes.

Of course, no DMS system can prevent you from seeking advice from experienced lawyers in domestic markets. They will still need to provide you with the required assistance on ongoing cases and law regulation developments. Nevertheless, using a DMS system for customs is something that can prevent your people from making mistakes on routine tasks that are not less expensive in general.

The matter of fact is that when you break the law in some countries like Belgium, you are committed to criminal law and convicted of a crime until you prove your innocence. This can result in your cargo being grounded for long months in international ports until you clarify that your company made a mistake unintentionally. There are enough reasons to consider document management software that can prevent you from such errors.

At Adexin, we're helping companies increase their capabilities in international freight by advising them on the best custom software solution for document management. With a strong presence in the European and US markets, we have a good understanding of today's transport regulations, which are crucial for excellent document workflow management solutions. Talk to us if you need assistance and support in transportation software solutions.