If your business operates internationally and you have registered facilities in Poland, this article may be helpful. It provides a brief understanding of what the national e-Invoicing system KSeF entails and helps you anticipate the challenges you may face in implementing and integrating KSeF with your business. Whether you operate internationally or solely in the domestic market in Poland, you'll need to confront this challenge.

We also share the benefits that you can expect from this solution in your business. In this article, you'll discover that you still have time to find a business partner to assist you with implementation. So, take your time and explore this material to better comprehend the current developments in the Polish market for B2B and digital document management.

What are the new VAT regulations in Poland?

The recent amendment to the VAT law in Poland introduces a mandatory requirement for using KSeF and e-Invoices in the obligatory form for all B2B transactions. This means that, from July 1, 2024, companies in Poland need to adapt to the system environment related explicitly to digital document management.

Of course, there is a slight relaxation in the law, and taxpayers eligible for KSeF subject to VAT will have an additional six-month period to switch to the new invoice format. The obligation for VAT-exempt taxpayers to use KSeF will begin on January 1, 2025. Thus, they will have an extra half year for final implementation.

Nevertheless, from January 2025, taxpayers who do not comply with these regulations will face sanctions. This may include penalties of up to 100 percent of the output VAT amount indicated on the invoice or 18.7 percent of the gross amount for invoices documenting VAT-exempt activities.

KSeF has been live since January 1, 2022, but for the past few months, we have seen a massive increase in transactions inside the system. There was a significant increase in data flow for several months, where the number of transactions increased by over 300%. That clearly means that companies in Poland have already started effectively utilizing the new system.

Looking through the penalties for not having the system in place should make it clear that to avoid it is necessary to find the proper IT support to help with implementation. But there is still enough time to find the right partner who can help implement the mentioned solution.

Who should and shouldn't use KSeF in Poland?

Looking for what is most important in this article, we now pay attention to all those entities that are obliged to use KSeF.

We have listed here transactions and entities that are obliged to be registered via KSeF:

B2B transactions. All invoices in B2B transactions between taxpayers registered for VAT in Poland will be sent and received exclusively through the national eInvoice system KSeF.

Permanent place of business. The system also covers foreign entities that have a permanent place of business in Poland.

Transactions with foreign counterparties. Invoices issued by Polish taxpayers to foreign counterparties (e.g., export of goods or services) will also have to be published in KSeF.

Several entities do not have to issue invoices in the national eInvoice system. We outlined those related, especially to logistics, transportation, and supply chain.

Here are the entities that are not obliged to use the national eInvoice system KSeF:

Foreign companies. All foreign companies without a permanent place of business in Poland involved in the supply of goods or services will be allowed to issue structured invoices only voluntarily.

Taxpayers. These taxpayers issuing invoices under the OSS and IOSS procedures will be exempt, but only concerning invoices issued under those procedures.

Non-business-to-consumer (B2C). Taxpayers issuing invoices to non-business-to-consumer (B2C) individuals.

Road services. Entities providing services for toll roads and carriers, including rail, bus, or air transport, issue invoices for a one-time ticket.

How to implement KSeF in the company?

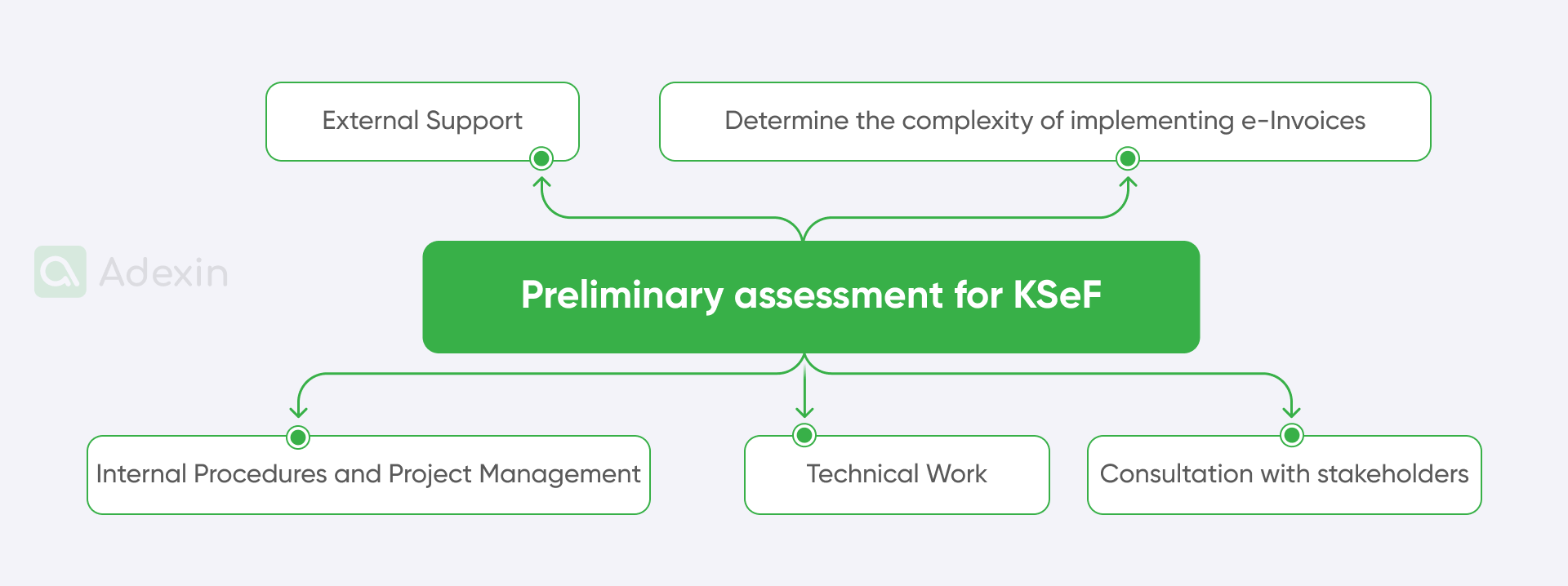

We cannot define the complete implementation path of KSeF for every company and industry. The complexity of each business is highly diverse, making it difficult to provide a one-size-fits-all solution. Nevertheless, relying on our experiences, we can offer a preliminary assessment for the implementation of such a solution. Despite our expertise in logistics, transportation, and supply chain, we're also experts in document management, and KSeF is definitely in our niche.

Here are the steps of the preliminary assessment for KSeF:

Determine the complexity of implementing e-Invoices

When working with any system, you may need to assess the impact of the change on various departments in your organization. Next, analyzing the volume and types of documented transactions is essential. Further, you may need to examine events not recorded in invoices affecting VAT settlements. This step also helps you to identify various document types and the diversity of business activities.

Internal procedures and project management

At this point, you may focus on determining the degree and specificity of internal procedures. After this, it is essential to analyze document flow within the company and evaluate strategies for tax settlements. Here, you may determine the needed access for external support from a custom software development company.

External support

Implementation of KSeF may potentially require external support in various areas. These areas refer to legal and tax aspects of performance and system, and IT support. Your business will need to take a comprehensive approach to project management.

Technical work

You'll need to dive into the project to look at the critical substantive issues for understanding e-Invoices. Analyze internal procedures and company systems. This will allow you to map data between the e-Invoice scheme and company transactional information.

Consultation with stakeholders

You may need to consult with stakeholders regarding the transition to e-Invoices. This will result in establishing terms for collaboration in the context of the new invoice format.

Need a digital transformation to develop your project?

Learn how we can boost your business processes

Explore moreHow to integrate KSeF in the company?

As it is pretty evident for many companies, there are already systems responsible for digital document management. Therefore, KSeF will only require an additional solution for your business that should integrate with the existing one. Hence, your business may need experts who are already technically savvy to implement a solution for digital document management.

We have outlined several important factors for effective KSeF integration:

Choose an integration strategy

Before initiating any integration, you should conduct effective technical reviews. During this process, you can determine different integration techniques and software approaches. At this step, you can also identify the skills you may require from your software development team, who should be involved from start to finish with this project.

System integration

By this point, you are already collaborating with your software development team or partners from a custom software development company, and the approach to integration is underway. Your experts will help you verify how the software code development should be implemented correctly. They will also validate central system functional expectations using details shared by the Ministry of Finance in Poland and representative units.

Software integration testing and configuration

Here, your developers start with an effective method for software design and testing to troubleshoot any problems that may occur. This is the moment where they discover and eliminate all possible issues during progression monitoring in KSeF solution integration. Next is the time for configuration due to management audits.

This is only a hypothetical scenario and significantly depends on the complexity of your business. Nevertheless, the approach may be similar at some stages, so it is good that you can have brief insights into the technical requirements of the project.

What are the benefits of the KSeF system?

The integration of structured e-Invoicing represents a significant shift in the paradigm for businesses. This is obvious, particularly in the context of Poland's unique e-Invoicing requirements and document digitization for companies. This transition offers a variety of potential benefits.

Here are the benefits of KSeF in your organization:

Streamlined accounting practices. Digitization of the invoicing process leads to streamlined accounting practices. Time and resources can be saved, allowing for allocation to alternative tasks and functions.

Error reduction. Skilfully integrated e-Invoicing has the potential to reduce errors in invoices. This, in turn, minimizes the need for rectifications and corrections, promoting accuracy.

Accelerated payment cycles. The automation of invoicing processes can expedite payment cycles. Faster payment processes contribute to improved cash flow for businesses.

Efficient resource allocation. With streamlined accounting and reduced error handling, resources can be efficiently allocated. Staff can focus on more strategic and value-added tasks within the organization.

Enhanced cash flow. The combination of faster payment cycles and accurate invoicing contributes to enhanced cash flow. Businesses can benefit from improved financial liquidity.

Deployment of a comprehensive strategy. Adopting a comprehensive strategy ensures the successful integration of e-Invoicing. Strategies should consider fiscal, legal, and technological dimensions, aligning with management and business imperatives.

Solving practical challenges. Recognition and resolution of practical challenges, such as attaching files to KSeF invoices and accounting for staff expenses, are crucial. Ensuring accurate validation for purchase invoices is vital for a smooth e-Invoice management process.

Operational efficiency potential. Structured e-Invoicing provides the potential for operational efficiency through standardized processes. Automation and standardization contribute to consistent and efficient workflows.

Compilation with legal requirements. Meeting legal requisites is a crucial advantage, ensuring compliance with Poland's e-Invoicing regulations. Proper adaptation to legal frameworks safeguards businesses from potential legal issues.

Risk mitigation. Implementing e-Invoicing with good planning helps mitigate risks associated with non-compliance or errors. Proactive risk management contributes to a smoother transition and operation.

Are you in search of a reliable tech partner?

Adexin can help with advanced logistics solutions

Contact usFinal takeaway

The implementation of KSeF includes self-invoicing, representing a significant advancement for the domestic economy in Poland and a crucial step for businesses. This development promises numerous advantages, particularly in enhancing business transparency. However, for many companies, the most critical aspect will be avoiding fines and ensuring compliance with legal regulations, and this is where we want to assist your business.

Adexin is a custom software development company that helps businesses integrate and implement complex business systems. We have a track record of delivering best-in-class support, maintaining high quality, and offering affordable prices. Contact us today if you want to learn more about implementing KSeF.

Version in Polish here.