Climate change is a global problem that needs global solutions. As the EU raises its climate ambition and as long as less stringent climate policies prevail in many non-EU countries, there is a risk of so-called 'carbon leakage.' Carbon leakage occurs when companies based in the EU move carbon-intensive production abroad to countries with less stringent climate policies than in the EU or when more carbon-intensive imports replace EU products.

The transitional phase of the EU's Carbon Border Adjustment Mechanism (CBAM) started on October 1, 2023. It complements the European Emissions Trading System (EU ETS) and imposes reporting obligations on importers of emission-intensive goods into the EU.

As the EU Carbon Border Adjustment Mechanism (CBAM) comes into effect, the time to invest in your supply chain software development is now. Organizations who proactively engage with CBAM may achieve future competitive positioning against their peers, avoid potential fines, and prevent a loss of market share. Read on to find out how you can control your carbon emissions with Adexin and what tools we offer you to use now to automate and optimize your logistics and supply chain processes.

What is CBAM? Main goals, objectives, and status

The European Union's (EU) Carbon Border Adjustment Mechanism (CBAM) initiative has attracted international interest and attention.

The main goal of CBAM is to combat climate change and reduce greenhouse gas emissions by economically compensating for the so-called "Carbon leakages" when EU countries purchase carbon-intensive products from countries with poorly developed carbon regulations. The mechanism is a system of introducing taxes on carbon emissions for imported goods (i.e., products produced with high greenhouse gas emissions will be taxed upon import into the EU). CBAM can be compared to a customs duty on imported products, depending on the volume of direct greenhouse gas emissions formed during production.

Conversely, CBAM aims to align the carbon prices of goods imported into the EU with those produced in the EU. Since under the EU ETS, only EU producers have to purchase certificates, thus raising their prices compared to imports, the CBAM aims to level the playing field. CBAM is the first regime in any emission trading system, though the EU Commission maintains that it is a WTO-compatible measure that boosts global sustainability.

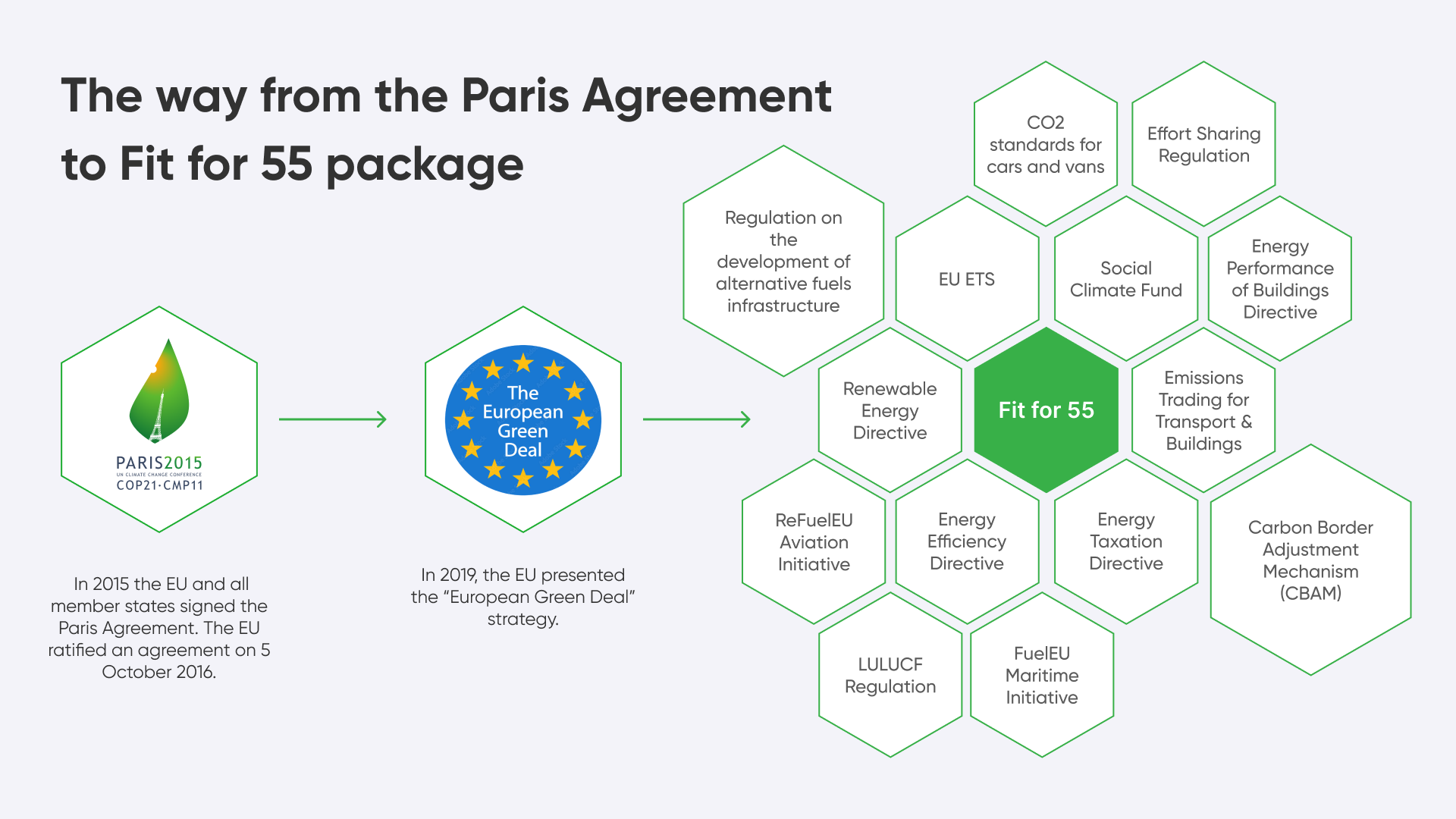

As a front-runner in climate protection and a driver of the global environmental agenda, Europe aims to become the world's first climate-neutral continent by 2050. The European Green Deal, introduced in 2019 and adopted in 2020, is a roadmap of tax and non-tax policy initiatives designed to achieve this ambitious target. In September 2020, the EU announced its ambition to cut emissions by 2030 by 55 percent compared to 1990 levels. To meet this target, a series of legislative proposals designed to facilitate the necessary acceleration of GHG emissions reduction by 2030 and align the EU's climate, transport, land use, energy, and taxation policies with this milestone target was adopted by the European Commission in July 2021 under the "Fit for 55 packages" banner.

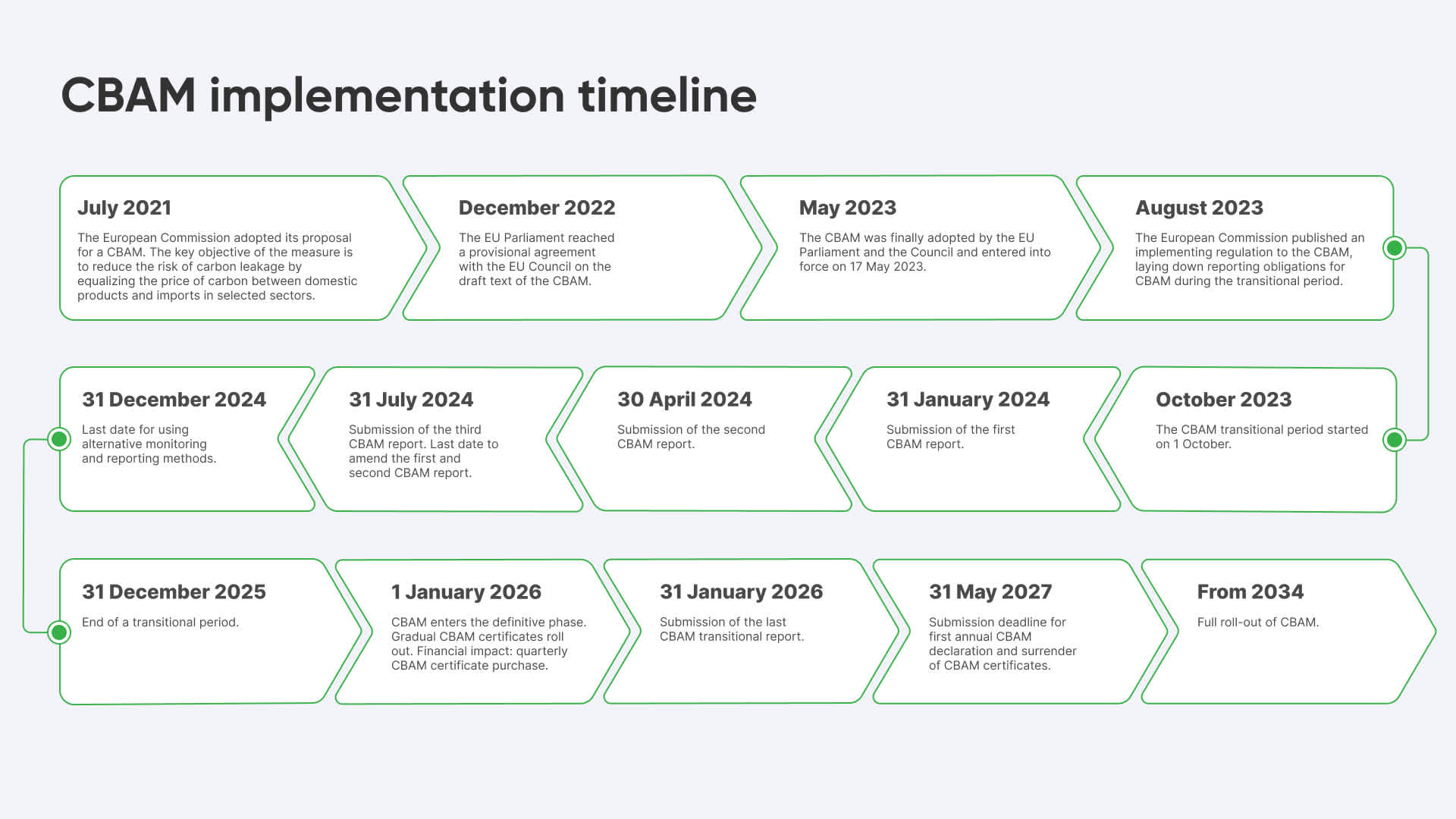

The CBAM entered into force on May 17, 2023, and directly applied to all EU Member States following the Regulation. With CBAM's "transitional phase" starting on October 1, 2023, affected companies now have to collect the information necessary for upcoming periodic reports on imports and emissions. Certificate trading will only gradually start when CBAM enters its "final stage" in 2026.

For now, CBAM importers face reporting obligations, with the first quarterly CBAM reports due on January 31, 2024. However, due to difficulties with the actual filing of the report, the Commission has published that companies can file a request for delayed submission, giving them an additional 30 days to submit their CBAM report. After that, starting on January 1, 2026, the Authorised CBAM Declarants must submit annual CBAM reports and purchase/surrender CBAM certificates (e.g., the financial implications start on January 1, 2026). These CBAM certificates will be pegged to the average price of allowances under the EU ETS, thereby equalizing carbon pricing costs between the EU and non-EU producers.

Why does the CBAM matter and who is responsible?

Compliance with CBAM is mandatory for the 'Authorised CBAM Declarants' and indirect customs representatives during the transitional period. The CBAM applies to all in-scope imports where the shipment value is equal to or greater than EUR 150 (the EU customs declaration threshold). The low value de minimis means many organizations will fall under the scope of CBAM upon the first importation of an in-scope good.

These entities must ensure the timely lodgement of their quarterly CBAM reports during the transitional period and will need to establish access to credible embedded emissions data for their CBAM goods by July 2024. The importers of CBAM goods should intimately understand the embedded emissions profile of each imported product, as it directly affects costs and administrative burdens. Depending on cost pass-through possibilities, consumers or importers may bear these costs.

Companies that do not innovate to reduce their embedded emissions will face an additional cost for producing their goods. CBAM certificates must be purchased based on the carbon emissions embedded in the imported product. This cost, while not directly borne by the manufacturer of the goods, will increase the indirect production cost for the customer. Where a company innovates to reduce its embedded emissions, it may face lower (or no) CBAM certificate cost, in which case it may be eligible to claim a price premium for its goods.

When CBAM enters the 'definitive phase' (from January 1, 2026), a credit will also be available for carbon taxes paid in the local jurisdiction where the CBAM goods are produced. In effect, this achieves CBAM's goal in that it would equalize the price associated with carbon emissions between the EU (via CBAM) and the local country of production.

Suppliers of CBAM goods may have already received information requests from EU customers for emissions data. Failure to comply may result in a loss of market access and a shift in demand away from their products. CBAM will mandatorily apply to EU customers, so they have no choice but to shift away from non-cooperative suppliers (due to the financial and non-financial burdens of non-compliance with CBAM).

Also, with the start of certificate trading on January 1, 2026, importers must purchase sufficient emission allowances for imported embedded emissions during the year. Within the framework of an annual CBAM declaration, the amount of imported embedded emissions will be compared with the acquired emission allowances. If too few certificates have been acquired, financial sanctions may be imposed.

The legislative timeline of the CBAM can be consulted immediately below.

Let's see what calculating emissions according to CBAM requirements provides to product manufacturers:

Access to the EU market. Compliance with CBAM requirements allows manufacturers and suppliers of products to maintain access to the EU market, which CBAM covers. It is important for companies dependent on exports and can contribute to long-term sustainability.

Risk reduction. Product suppliers that do not adapt to new environmental requirements and do not reduce their carbon emissions may face additional taxes and duties, increasing their operating costs. Calculating emissions according to CBAM requirements allows suppliers to see the risks of additional climate-related taxes and develop solutions to reduce them in time.

Compliance with international standards. CBAM helps ensure compliance with international greenhouse gas standards. Compliance with these standards is becoming increasingly important for many companies, especially those that export their products, especially given the growing interest in environmental sustainability from investors, customers, and partners.

Green trade support. CBAM promotes green trade and encourages consumers to choose environmentally friendly products. Suppliers that offer low-carbon products gain a competitive advantage in the global market and can increase their sales.

Incentives to reduce emissions. CBAM creates financial incentives for suppliers to reduce greenhouse gas emissions when they produce their products. It allows companies to comply with CBAM requirements and reduce their carbon footprint, saving them money in the future.

Which goods fall within the CBAM scope?

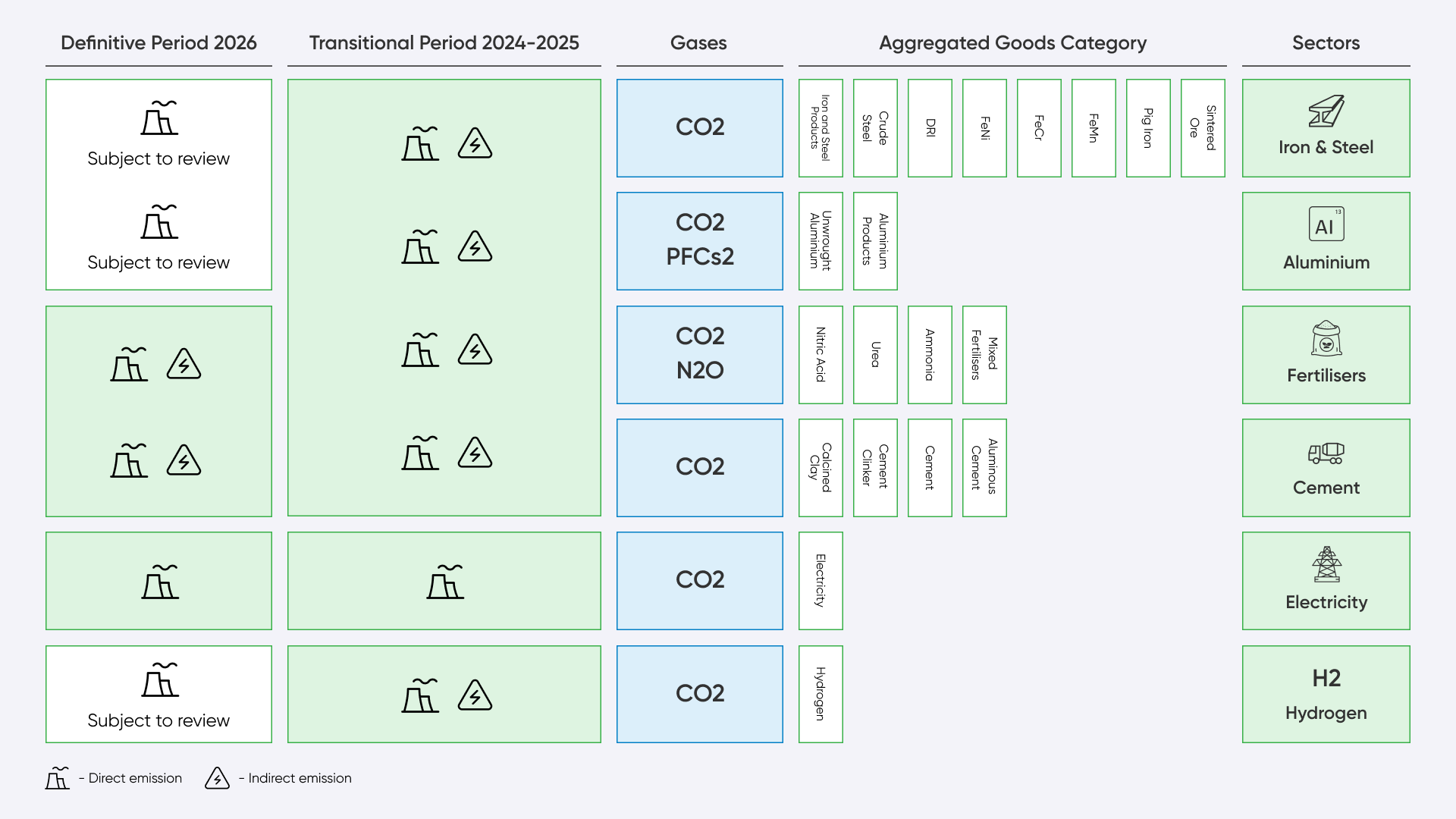

During the transition phase from October 1, 2023, to December 31, 2025, CBAM applies "only" to imports of certain CBAM goods. While the scope is expected to expand in the future, for the time being, the combined nomenclature codes, as listed in Annex I of Regulation (EU) 2023/956 (p. 90 onwards), set out the types of goods that will be affected:

Certain iron and steel goods and certain goods (e.g., bolts)

Aluminium and goods made of aluminum

Iron ore and hydrogen

Some fertilizers

Electricity

Mineral products (cement)

CBAM applies to goods or certain processed products made from these goods. Furthermore, there is no de minimis rule for small companies that import low numbers.

CBAM regulation lists sectors and aggregated goods categories as illustrated below. Each aggregated good category contains subsequent CN codes. If you find your imported items in the file below, they are subject to CBAM regulation, and their respective emissions must be reported.

CN codes subject to CBAM can be downloaded in XLS format here

Also, CBAM regulates emissions of three groups of greenhouse gases:

carbon dioxide (CO2)

nitrous oxide (N2O)

and perfluorocarbons (PFCs)

Fertilizers produced under CN code 2814, "Ammonia, anhydrous or in aqueous solution," need to be reported only as CO2.

Emissions will also be taken into account:

Direct emissions are the emissions arising from the production process of goods to which the CBAM regulation applies.

Indirect emissions are the emissions from generating electricity used to produce the goods to which the CBAM regulation applies.

The product categories were not chosen by chance: they are the most carbon-intensive (that is, they are characterized by significant greenhouse gas emissions during production). The movement of carbon-intensive products between countries causes the transfer of intercountry "carbon leaks." Preventing these "leaks" is the main goal of introducing CBAM in the EU.

"Carbon leaks" (or "emission leaks") are greenhouse gas emissions that are formed during the production of products not in the EU but in other countries with less strict carbon regulations. Leaks occur when manufacturers move their production from countries with strict measures to reduce carbon emissions to regions where these measures are less developed or nonexistent. Thus, such productions are not subject to the regulatory framework for reducing greenhouse gas emissions and reporting. However, the total greenhouse gas emissions along the supply chain do not decrease since production facilities outside the EU have no incentive to adhere to low-carbon development. In addition, imported products, the cost of which does not include taxes on carbon emissions, reduce the competitiveness of manufacturers' products in the EU.

Thus, the introduction of the CBAM mechanism will increase the competitiveness of the EU's products, avoid carbon leakage, and motivate manufacturers to reduce greenhouse gas emissions in product production.

Exemptions currently exist for goods originating in Liechtenstein, Norway, and Iceland, as those countries participate in the EU ETS, and for goods originating in Switzerland, as the Swiss emission trading system is linked to the EU ETS. The exemption rule is expected to be extended to other countries, depending on their CO2.

The introduction and implementation of a CBAM in the United States would represent a significant step toward addressing the challenges of carbon leakage, maintaining industrial competitiveness, and promoting global climate action. However, several limitations and uncertainties must be addressed to ensure the successful design and implementation of a U.S. CBAM. While it is encouraging to note that the U.S. legislative proposals demonstrate a growing recognition of the need for carbon pricing and border adjustment mechanisms, the ultimate success of a CBAM will depend on careful navigation of legal, economic, and political challenges. Policymakers must balance addressing climate change, maintaining international competitiveness, and promoting fair and inclusive trade practices. By addressing the limitations identified in the analysis and leveraging the lessons learned from the European Union’s implementation of its CBAM, the United States has an opportunity to play a pivotal part in the global transition toward a low-carbon economy, while fostering international cooperation and harmonization of climate policies.

The scope and coverage of a potential U.S. CBAM play a pivotal role in determining the resultant tax revenue. With the EU CBAM focusing on a select range of products and sectors, recent U.S. legislative proposals have similarly maintained a narrow focus on product coverage for border adjustment and emissions reduction. In terms of scope, both the EU model and U.S. legislative proposals prioritize measuring Scope 1 and 2 emissions, primarily due to their relative ease and reliability of measurement.

After implementing the CBAM, the EU Commission plans to extend the scope of application to all sectors subject to EU emissions trading by 2030.

What does CBAM mean for business and what are the supply chain implications?

Businesses should already start preparing to adapt to the upcoming changes, which are almost upon us. Adherence to reporting obligations from October 1, 2023, is among the most urgent for EU companies to align themselves with the CBAM regulation. For businesses to achieve a smooth rollover in the upcoming transition period and minimize the disruption to their business model and costs, all EU importers of initial covered products must be ready for these transitional period reporting obligations.

Many EU-based corporations will be monitoring the emissions performance of their supply chain to meet the monitoring, verification, and reporting standards now expected of most corporate entities. However, few companies will know in what country the actual emissions relating to the development of their goods were generated. Companies that consume products covered within the scope of the EU ETS (e.g., manufacturing) could face significant additional cost pass-through from existing suppliers if the CBAM is implemented due to the significant emissions occurring in geographies without commensurate low carbon policies and the emissions associated with the transport of the goods to the EU. Corporations should ensure that they understand the geographical composition of their emissions to enable them to undertake a supply chain review, where required, making conscious cost versus carbon trade-offs and ensuring the resilience of their pricing model to the proposed changes.

As more products fall into the scope of the expanded execution of CBAM, more businesses will need to prepare for its implementation. Companies and importers of CBAM goods in the EU must remain well-informed of these developments and begin evaluating the overall impact on their business activity, which may not be limited to a view on their customs data only but also impact their sourcing and supply chain.

So, let's see what companies need to do now:

Understand. CBAM compliance requirements and potential impact.

Review. Global supply chain, CN (HS) codes for in-scope products and data availability.

Prepare. From reporting obligations to registering for CBAM.

Engage. With in-scope wendors.

What companies need to do from 2026/2027 onwards:

Calculation of embedded direct and indirect emissions (actual or default values)

For actual values: verification by certified test center

Acquisition of CBAM certificates from the relevant CBAM authority

Prepare and file an annual CBAM declaration by May 31

So far, we've discussed the CBAM, its responsibility, the enforcement mechanisms, and how this Regulation might evolve and be implemented. While the CBAM has carbon tax implications, it also has significant supply chain implications:

Supplier data will directly impact product EU pricing

CBAM pricing is tied to a good's embedded emissions, so inaccuracies in emissions data can lead to miscalculated carbon costs. For example, if a steel manufacturer overestimates emissions, the importer may surrender excess CBAM certificates, increasing costs and raising steel prices in the EU market. This, in turn, could affect the demand for steel products, impacting both the importer and supplier.

Supplier data will create future (and potentially compounding) legal exposure

Importers will face significant financial penalties for inaccurate emissions reporting, with the severity escalating based on the duration of the problem. CBAM reports and their accuracy will be wholly reliant upon supplier-provided data. To mitigate risk, importers may impose contractual conditions, indirectly holding suppliers accountable for CBAM. Failure to meet these conditions may result in penalties for suppliers or termination of contract where issues cannot be rectified.

Supplier information and potentially upstream relationships will be key to supplier data accuracy

Recognizing suppliers' pivotal role, importers are expected to enhance their relationships with suppliers, ensuring their internal systems comply with CBAM reporting obligations. This collaboration may extend to aiding direct suppliers in partnering with upstream suppliers to gather data, especially in producing goods involving precursors.

Assurance of data will be important

Maintaining data integrity is crucial for accurate CBAM certificate surrender, effective carbon pricing of CBAM goods, and preventing financial penalties. Therefore, robust data assurance measures in the supply chain will be necessary for transparent and reliable reporting. Suppliers may need to collaborate closely with importers and auditors to provide comfort over the accuracy of embedded emissions data. From January 1, 2026, the CBAM will require independent verification of CBAM reports.

Rethink supplier engagement and your broader sustainability agenda

To avoid incurring higher expenses from paying carbon taxes, businesses should consider how they can decarbonize their supply chains and work with suppliers to find carbon efficiencies. This can create an opportunity to gain a competitive advantage while improving communication and transparency with suppliers.

What are the main work stages in preparing the CBAM declaration?

So, you have stubbornly decided to start preparing to obtain certificates now, then look at what you need to pay attention to and how to act:

Determine boundaries. Map out your high-level, global product value chain, pinpointing key activities with the EU and tracing the flow of goods into the region. Engage your procurement, tax, operations, and logistics teams to effectively determine which activities fall under the scope of CBAM. This assessment should include the indirect tax/customs team due to the link to EU customs regulations.

Enable legal framing and terms. Revise standard contracts for CBAM suppliers by incorporating clauses that mandate accurate and timely embedded emissions data for CBAM goods, require collaboration on data improvement, clearly define supplier responsibilities for CBAM compliance, specify the party responsible for carbon certificate costs, and outline consequences for non-compliance. Additional clauses concerning confidentiality and data storage should also be considered.

Evaluate and identify the impacted supply chain. Thoroughly map your supply chain to identify CBAM goods suppliers, analyzing from raw material sourcing to end-product distribution to capture the use of precursors. Assess suppliers' compliance with CBAM regulations and their capability to provide lower carbon-intensive goods. Based on this evaluation, consider engaging alternative suppliers.

Determine training, knowledge, and data requirements. Identify key value drivers, enablers, constraints, barriers & ambitions (with timelines) for CBAM reporting. To improve efficiency, assess across the reporting ecosystem to identify areas of overlap and synergies in data collection, management, and analysis (for example, some of the data points of CBAM may already be identified as part of the EU CSRD, US SEC disclosures or other sustainability reporting). Address gaps by improving data collection systems, training affected personnel and suppliers, and establishing guidelines and protocols to ensure CBAM compliance. Please refer to the manual provided by the European Union authorities.

Create a proliferation and engagement plan, including "help lines" with expert knowledge. CBAM will require involvement across functional teams, from sustainability to procurement, tax, finance, supply chain operations, and logistics. Ensure roles, responsibilities, and expectations (i.e., data requirements) are communicated early. Investigate opportunities to partner with industries or organizations specializing in carbon pricing to exchange ideas, best practices, and insights.

Remember, if one company's goods are integrated into another's goods, the company from whom the importer requests information is expected to obtain the necessary information from the other operators in the supply chain. Supply contracts must be updated to include contractual obligations to supply the necessary data. Companies affected by similar national supply chain laws might build on existing clauses.

While in previous EU and national legislation, small enterprises often received exemptions (de minimis rules), this won't be the case for CBAM. In some cases, importers and manufacturers will face such reporting obligations for the first time, so they should prepare as soon as possible.

So, to be approved by the competent authority, an applicant company must meet the following criteria:

The applicant has not been involved in seriously infringing customs legislation, taxation rules, or market abuse rules.

It demonstrates the financial and operational capacity to fulfill CBAM obligations.

It is established in the Member State where the application is submitted.

An EORI number (Economic Operators Registration and Identification) has been assigned.

It will be important that companies have the necessary operational and legal measures in place before then to prove "operational capability" to fulfill CBAM obligations. For the transition phase up to December 31, 2025, an Indirect Customs Representative can be used as a substitute for a CBAM Declarer.

Step-by-step taxation procedure according to CBAM

For the importers in the transition phase, information-gathering obligations apply from October 1, 2023, with quarterly reporting requirements. The first report to be submitted to the European Commission is due on January 31, 2024. The report must include:

Energy use is the total quantity of each commodity type in MWh for electricity and tons for other commodities. The Regulation requires that it is reported for each facility producing the goods in the country of origin.

Embedded emissions, total actual embedded emissions expressed in tons of CO2 emissions per MWh of electricity, or tons of CO2 emissions per ton of each product type for other products (calculated using the methodology set out in Annex IV), and total indirect emissions or default values provided by the EU Commission until June 30, 2024.

Country of origin of imported goods, identity, and location of the facilities where the goods were produced

Carbon price to be paid in the country of origin for emissions contained in imported goods, taking into account relevant rebates or other forms of compensation.

After the transition phase, importers will be required to purchase CBAM certificates. Reporting obligations are reduced from quarterly to annual reports due by May 31 of each year, with the first report due on May 31, 2027, for the year 2026.

The tax directly depends on the amount of greenhouse gas emissions accompanying the production of imported products. The calculation takes into account direct emissions according to Scope 1 associated with the technology of production of goods and, in the transition period, indirect emissions from purchased energy used in the production of products. Here, you can study any taxes, including CBAM.

As a fee for emissions, CBAM provides for the purchase of so-called CBAM certificates on the EU ETS (EU Emissions Trading System) exchange. One certificate will cover the emissions of one ton of CO2e. The value of the certificate will be equal to the value of a carbon unit on the EU ETS exchange. For example, on January 31, 2024, the value of one CBAM certificate would be €63.38, according to the information platform Carbon Credits.

When determining the amount for which CBAM carbon certificates should be purchased, it is possible to consider payments made for excess CO2e emissions quotas or purchased carbon units in the country of origin of the product. Thus, if the manufacturer can prove that it has already paid the price for a certain amount of excess CO2e emissions within the framework of the carbon regulation of the country where the production is located, the corresponding amount of emissions can be deducted from the tax amount (this procedure is set out in Article 7 of Commission Regulation EU 2023/1773). In this case, importers will not have to purchase certificates for the entire tax amount but only for the difference between the calculated emissions according to CBAM and the emissions already paid for before importing the product into the EU.

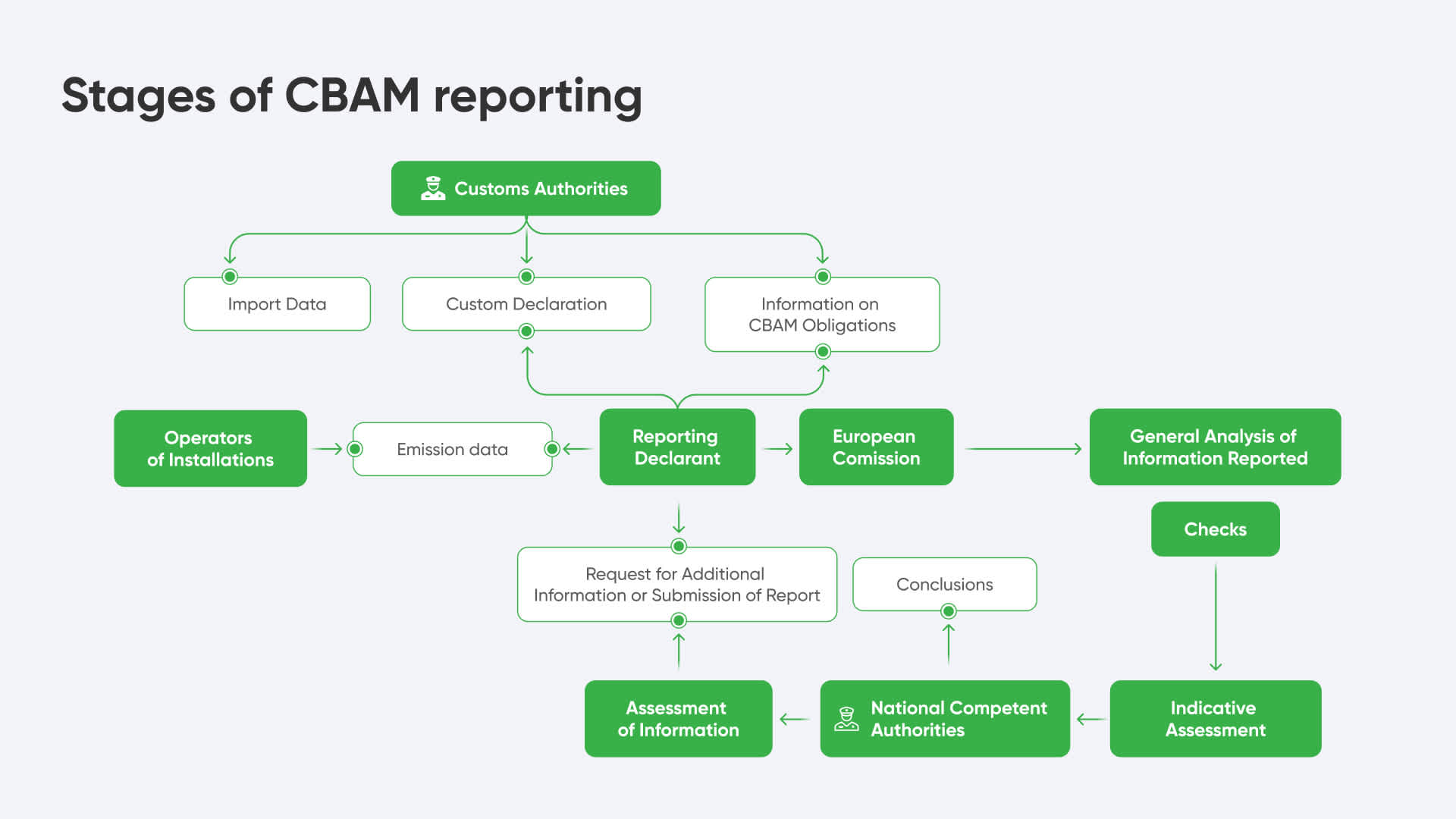

The stages of CBAM reporting are presented above, but let's also look at the general CBAM taxation procedure, which can be represented as follows:

Calculation of the carbon footprint

Manufacturers of goods imported into the EU are recommended to calculate their products' carbon footprints. Each type of product that falls under the CBAM requirements has its methodologies for calculating greenhouse gas emissions. To simplify the calculations, a calculator is available on the EU website, which is currently being finalized, as well as several other necessary forms that simplify the submission of all the necessary documentation. Manufacturers transfer the calculated values of embedded emissions to importers of products to the EU.

You can also use the manual instructions for all calculations; just follow all the recommended steps carefully.

And remember, for the transitional period of the CBAM, indirect embedded emissions have to be reported separately from the direct embedded emissions for all goods covered. Indirect emissions of an installation or a production process are equivalent to the emissions caused by the production of the electricity consumed in the installation or the production process of goods, respectively, multiplied by the applicable emission factor for electricity:

AttrEmindir = Emel = Eel ∙ EFel

Where:

AttrEmindir are the indirect attributed emissions of a production process expressed in t CO2;

Emel are the emissions related to electricity produced or consumed, expressed in t CO2;

Eel is the electricity consumed expressed in MWh or TJ;

EFel is the emission factor for electricity applied, expressed in t CO2/MWh or t CO2/TJ.

The general rule for the emission factor is to use a default value provided by the European Commission for that purpose.

Registration in the CBAM register

Importers who submit a customs declaration must register in the CBAM register of authorized declarants.

Submission of CBAM reporting

The generated report, containing information on the volumes of purchased products, volumes of direct and indirect emissions, built-up emissions of products, as well as other required information, is submitted for review via the CBAM Reporting Declarant Portal.

Audit and verification

The results of the product carbon footprint calculation can be audited and verified. This ensures the accuracy and reliability of the information provided. To confirm the accuracy of the reporting, the importer can use the services of a third-party accredited verifier. In this case, the trust in the transmitted data increases, and the importer reduces the risk of receiving a fine for incorrect reporting. Voluntary verification will remain only during the transition period. From January 1, 2026, verification of reporting by accredited verifiers will become mandatory. Requirements for verifiers, as well as systems for imposing fines and sanctions for incorrect reporting, are currently under development.

Determining the tax rate

The tax rate for a specific product is determined based on the carbon footprint calculations. The emission fees paid by the manufacturer in the region of production according to local carbon regulations are taken into account when calculating the tax rate.

Collection of the tax

The established tax is paid by product importers who purchase and provide a certain number of CBAM certificates. The certificates will be purchased in the EU ETS; their value will be equal to the value of a carbon unit on the EU ETS exchange. Specific mechanisms for purchasing certificates have not yet been established; they will be developed during the transition period of the CBAM system implementation.

The CBAM system will be constantly improved during the implementation. The list of products that fall under the CBAM requirements and the emission categories required for accounting will be expanded. It is planned that by 2034, 100% of the embedded emissions of imported products will be taxed. Therefore, it is strategically important for all companies supplying products to the EU to calculate greenhouse gas emissions and declare them following the CBAM requirements.

Failure to comply with CBAM reporting requirements or inaccuracies in CBAM reports can result in penalties set by each EU member state, ranging from €10 to €50 per ton of unreported or incorrectly reported embedded emissions. Authorized CBAM declarants who fail to surrender the necessary number of CBAM certificates by May 31 of each year starting in 2027 will be liable for the payment of fines equal to those under the EU ETS, meaning €100 for each ton of CO2.

Following the reporting obligations, ultimately, when certain goods are imported into the customs territory of the Union, they are subject to the same carbon price as they would have been if they had been produced in countries that are subject to the European Emissions Trading System (EU ETS. This obligation will start in 2027 for the year 2026. The CBAM certificates will be sold via a platform operated by the EU Commission. The obligation to purchase and surrender CBAM allowances will gradually increase, corresponding to reducing the free allocation of EU ETS to EU producers.

Importers will initially have to pay for only 2.5% of embedded emissions for 2026, and this rate will gradually increase to 100% of grey emissions by 2034. Companies already affected by other reporting obligations (such as EU Taxonomy, CSRD, and national supply chain acts) should carefully assess where data that's already being collected can be reused for CBAM and where there are significant differences.

How we can help on the way to acquiring CBAM certificates?

During the transition period, importers must identify and document direct and indirect emissions that occur during the production process of imported goods. This step is likely to pose challenges for many companies, as the necessary IT solutions for recording and determining carbon dioxide (CO2) equivalent emissions are often unavailable.

Whether you are in the EU or trading with the EU, we encourage companies to consider their decarbonization strategies, whether it be to ensure that they are prepared for compliance with upcoming legislation or to ensure that operations are future-ready for medium- and long-term global developments.

Adexin's experts can help you with a decarbonization strategy. This includes helping you gain strategic foresight and operational value in your decarbonization journey, from emissions measurement to implementation, monitoring, and reporting. A range of options support this through the effective implementation of custom supply chain management software developments.

Need help developing a decarbonization strategy for your supply chain?

Learn how we can boost your business processes

Explore moreFinale takeaway

The article presents a comprehensive study of the importance and benefits of the implementation of SBAM certificates for the entire supply chain. The main points discussed revolve around the need to implement digital transformation to improve the accuracy of calculations in reporting processes.

As the EU Carbon Border Adjustment Mechanism (CBAM) comes into effect, the time to invest in your supply chain operations is now. Organizations that proactively engage with CBAM may achieve future competitive positioning against their peers, avoid potential fines, and prevent a loss of market share.

We encourage all readers to take note of the information and start the process of studying all available documentation now. Remember, obtaining SBAM certificates is your open path to the borders of the European Union. Find out more, contact us, and let's talk about how we can help you optimize your business.