Last-mile delivery is the final leg of a product's journey from a distribution center to the customer's doorstep. In other words, the last mile of delivery is often a fraught journey a package makes from a local hub to your front door. So, frankly, it'sn't just a logistical challenge, it's a hidden story of rising last-mile delivery expenses and evolving consumer expectations.

Imagine that Sarah, a busy working mom, is ordering a new toy for her son's birthday. She clicks "buy now," expecting it to arrive quickly. Well, there is a chance that she expects the package delivery to be done even today. For the eСommerce company, fulfilling Sarah's wish for speed means navigating a complex web of expenses that kick in after the truck leaves the main sorting facility.

On the other hand, for many managers, meeting Sarah's expectations is often the most challenging and expensive part of the supply chain. It's where the rubber meets the road, I mean, the factual place where the daily struggles faced by logistics providers can significantly impact customer satisfaction and profitability.

While working in the supply chain, I can recall many issues that really affected overall KPI performance dedicated to transportation. The main problem with last-mile delivery I could describe now is that last-mile delivery is inherently inefficient due to numerous individual stops, often accounting for over 50% of total shipping costs. This is so significant that companies consider possible cost reductions of up to 45% in an urban environment using cargo bikes…yes, they do. Not many of you may know that the last-mile delivery cost per unit is about an average of 1.60 EUR. This is because the total cost of the vehicle represents less than 15% of the overall cost of last-mile delivery in dense networks. So, it offers only limited potential for cost reduction.

We find it difficult to assess over time what is shaping these costs and what factors influence them as well. Only a deep look into data based on several quarters answers the main question about choosing the right management model for last-mile delivery. Well, I have a nice story for you about how to lower your overall cost. In this article, we deep-dive into aspects crucial to your costs in last-mile delivery.

Get the mile delivery cost breakdown

This last-mile cost, globally, amounts to a staggering €70 billion annually. This represents the financial burden of getting Sarah's toy the final few miles. Funny story with her, but this random person is a multi-billion customer of an average company handling last-mile delivery.

It's not about the airplane that flew across continents or the huge truck that brought it to her city. It's the fuel for the delivery van winding through suburban streets. This concerns the driver's wages and the considerable time spent finding parking. Going further with this subject, we have that brief moment when the package rests on her porch.

As more consumers like Sarah demand instant gratification and flexible delivery options, I know firsthand that these seemingly small, individual costs add up. This is pushing businesses to innovate furiously to keep pace and ensure that her son's birthday surprise arrives exactly when Sarah expects it.

I hope it gives you a clearer understanding of this last-mile delivery process, often behind rigid warehouse processes. Further in this article, we'll break down the story of delivery and cost into small chunks that highlight internal, external, and even more complex philosophical issues. This is all that last-mile delivery refers to.

I would call it a more sociological problem where customer satisfaction comes into play. I've just added this between the words to make this content more consumable for transport managers and tier colleagues in supply chain processes and last-mile logistics.

While crucial for customer satisfaction, the last mile of delivery faces significant external problems primarily driven by diverse consumer preferences and challenging geographical factors. It's a tricky balancing act for businesses trying to meet varied customer expectations while keeping total supply chain costs manageable.

Let's see what is causing failed deliveries:

Paying for fast last-mile delivery services

One major hurdle is the split in consumer willingness to pay for speed. While a notable 23% of consumers are willing to pay extra for the convenience of same-day delivery, and a small 2% for instant delivery, the vast majority, a hefty 70%, are content with the cheapest form of home delivery.

This creates a dilemma – how do you invest in cost cost-efficient route, expedited delivery infrastructure for a minority of customers when most prefer to save money? This disparity forces companies to offer multiple, sometimes conflicting, service levels, increasing operational complexity.

I will break it down for you even a bit more:

Dilemma of investment. Companies must decide whether to invest heavily in premium and fast delivery services that only a minority of customers will pay extra for. Again, this is a bit more focused on cheaper, slower options that cater to the majority.

Filling the customer expectation gap. While 5% would pay more for reliable, timed delivery, the preference for the cheapest option makes it hard to justify widespread premium services, yet customer expectations for speed continue to rise.

City habitats and drop density

Beyond price sensitivity, drop density presents a substantial external problem. In rural areas, we can say, for instance, that longer distances between delivery points significantly increase last-mile costs. It's far less efficient for a delivery vehicle to travel many miles for a single package than to drop off multiple parcels in a dense urban neighborhood. This geographic challenge means that a one-size-fits-all delivery strategy is unsustainable. It forces companies to adapt their networks and technologies to highly varied environments.

Need help with last-mile delivery software for your business?

Learn how we can help you

Explore moreInternal problems in the last-mile delivery for CEP

One significant internal challenge for CEP players is their innovation bias, which tends to neglect crucial areas of last-mile technology. Despite dedicating most of their innovation efforts to IT and tracking technology. We should know that a patent analysis reveals a comparative oversight in developing direct last-mile delivery technologies. While they excel at managing data and tracking parcels, they may lack the right solutions for the physical delivery mechanisms.

Underinvestment in last-mile automation

CEP, so to speak, a network of courier, express, and parcel companies, is the players' innovation focus, which leans heavily towards software (e.g., 36.9% of patents in IT innovations) rather than physical technologies directly related to last-mile delivery, such as autonomous ground vehicles or advanced delivery robots. This is evident as only 15.7% of their patents are categorized under last-mile technology and allow for getting better delivery routes.

External expertise for advanced delivery models

Partnerships with commercial vehicle (CV) players are needed to gain access to additional value pools like autonomous driving vehicles (ADV). This affects operations and routing and suggests an internal deficiency in developing or deploying these asset-intensive technologies independently.

Potential for collecting data utilization

While CEP players collect vast amounts of data, commercial vehicles, so-called CV players, can benefit from insights distilled from this data and IT-related learnings. Thus, it suggests that CEPs might not be fully leveraging their data for comprehensive routing optimization or that their internal IT approaches could be enhanced through external perspectives.

Last-mile delivery cost structure and cost reduction

The anatomy of last-mile delivery costs isn't so simple. Let me tell you straight, the last mile represents the most complex and often most expensive segment of the delivery chain. It encompasses everything from when a package leaves a local distribution center until it reaches the customer's hands or a designated pickup point.

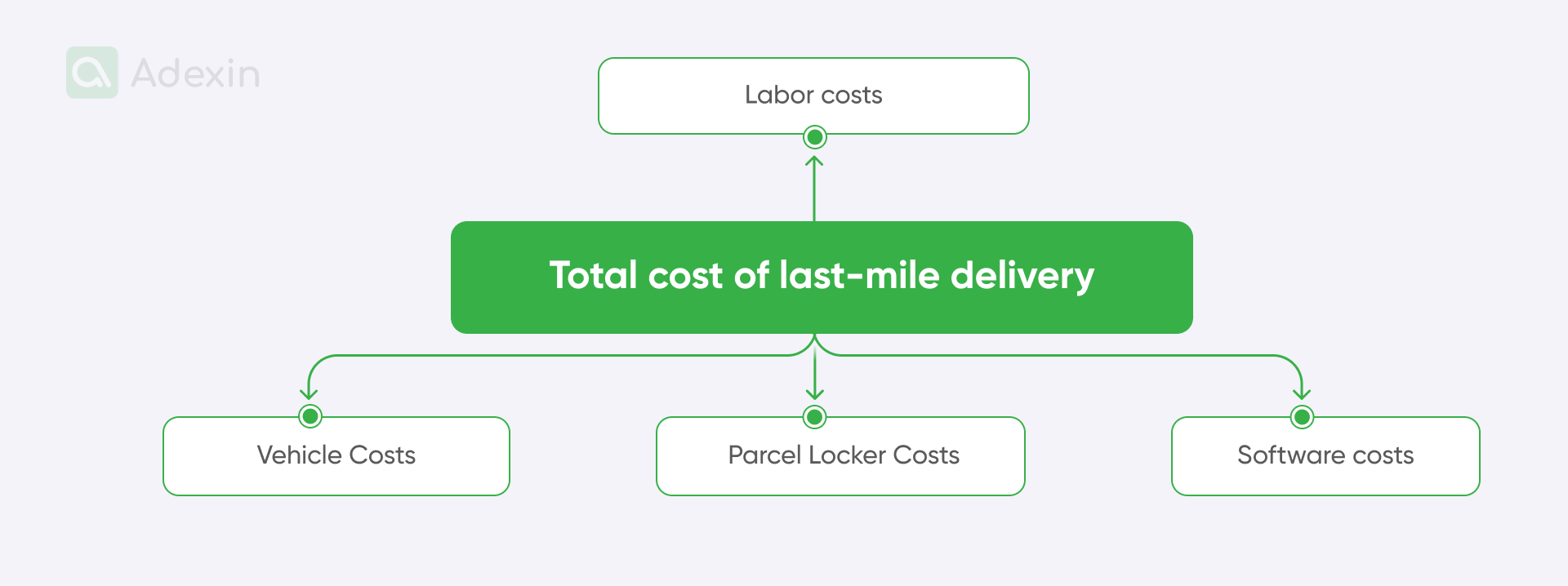

Understanding its final-mile delivery cost structure is crucial for optimizing efficiency and profitability. Based on the provided data, the primary components contributing to last-mile delivery costs are personnel, vehicle operation, parcel locker infrastructure, and essential hardware/software. See my breakdown below, where I used data from one of the researchers on last-mile delivery.

1. Labor costs

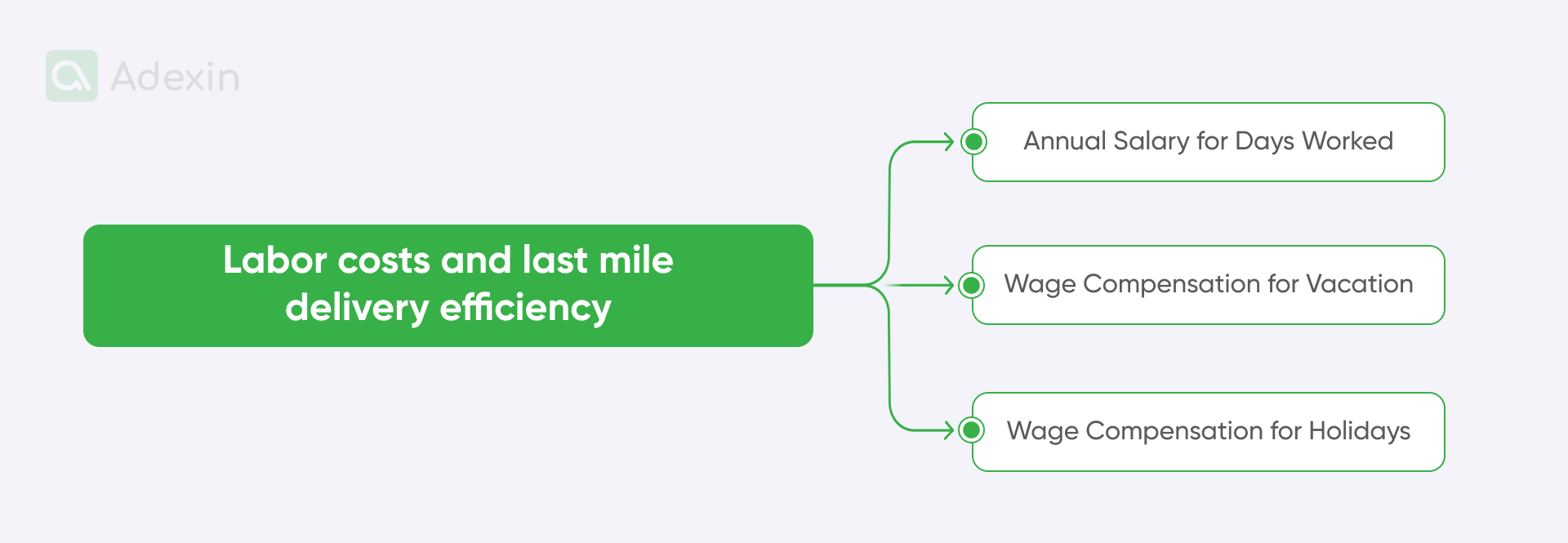

Personnel costs form the backbone of last-mile delivery, reflecting the human effort involved in sorting, loading, driving, and delivering parcels…and many, many more. These costs are primarily driven by wages, so they include compensation for actual workdays and paid leave.

Annual salary for days worked. This covers the direct wages for an employee's hours actively working. For the example provided, an employee working 221 days for eight hours a day at €6 per hour amounts to €10,608 annually.

Wage compensation for vacation. Employees are also compensated for their vacation time, a significant part of the overall personnel expense. In the given example, 25 vacation days at eight hours a day at €6 per hour total €1,200 annually.

Wage compensation for holidays. While a specific numerical example isn't provided, compensation for public holidays is another component of personnel costs, ensuring employees are paid for non-working days.

The total estimated annual cost of personnel is €11,808

2. Vehicle costs

Operating a delivery fleet involves substantial expenses, covering everything from the initial purchase to ongoing maintenance. Let's not forget about the fuel and regulatory fees, which are directly tied to the vehicle's usage and operational environment.

Vehicle depreciation and delivery. The cost of the vehicle itself is spread over its useful life. For a Peugeot BOXER FURGON purchased at €19,600 with a four-year depreciation period, the annual depreciation cost is €4,900.

Insurance (PZP and HP). Mandatory and comprehensive insurance are significant annual outlays. For the example vehicle, PZP costs €169.56 per year, and HP costs €1,238.44 per year, totaling €1,408 annually.

Fuel costs. Fuel consumption is a significant operational expense, and it is directly proportional to the distance covered. Assuming 5,000 km per month (60,000 km annually), 5.9 liters per 100 km, and an average diesel price of €1.240 per litre, the annual fuel cost is €4,389.60.

Operating refills. Essential fluids like AD Blue and washer fluid contribute to regular operational costs. Purchased approximately every two months, these amount to (€10.70 + €6.50) * 6 = €103.20 annually.

Highway stamp. An annual stamp is a necessary expense for vehicles operating on highways. It is listed at €50 per year.

The total estimated annual vehicle cost is €10,850.80

3. Parcel locker costs

Parcel lockers offer an alternative delivery method. So, reducing the need for direct home deliveries and potentially optimizing routes. However, they come with their own set of infrastructure and operational costs.

Operational costs. These cover the day-to-day running and maintenance of the parcel machine, including utilities, connectivity, and minor repairs. For a 20-mailbox machine, this is €2,930.95 annually.

Transport cost to the locker. This refers to transporting parcels to the locker itself, a crucial part of its operational expense. This is listed at €7,216.92 annually.

Construction cost. While not an annual operating cost, the initial construction cost of a parcel machine (e.g., €21,839.20 for a 20-box unit) is a significant capital expenditure that needs to be amortized over its lifespan.

The total estimated annual parcel locker cost is €10,147.87

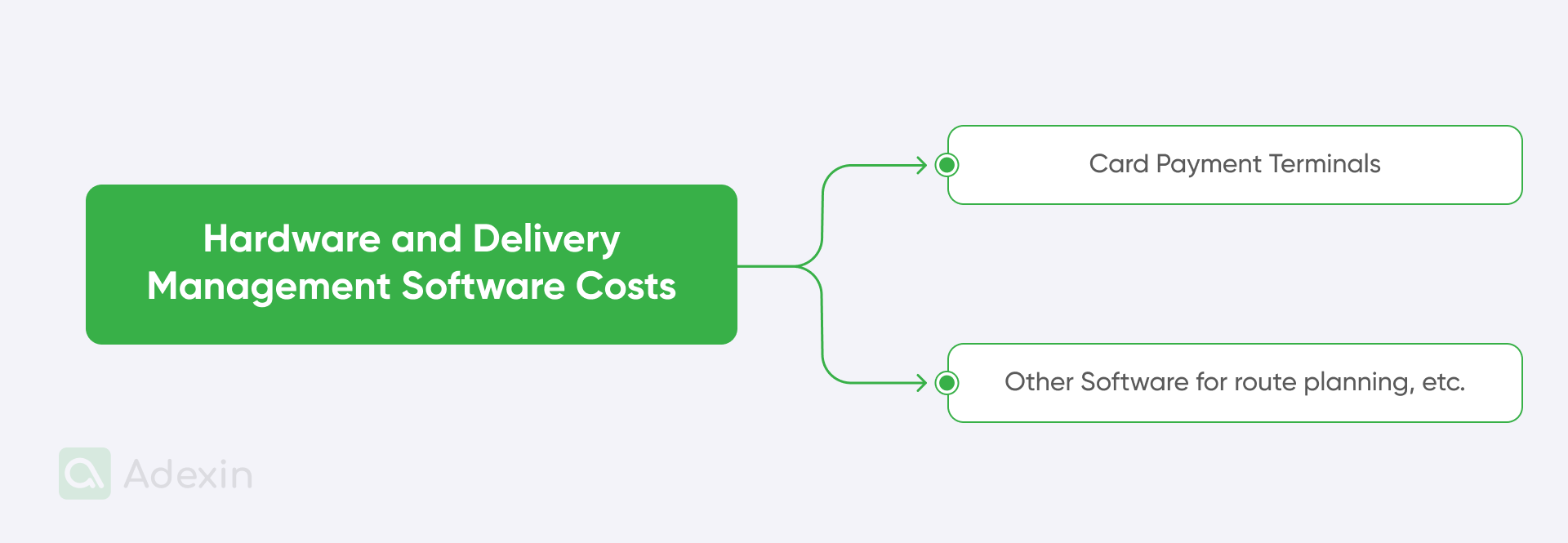

4. Hardware and software costs

Technology plays a vital role in efficiency and customer experience in the modern delivery landscape. This includes payment systems and other digital tools.

Card payment terminals. Card payments are becoming increasingly popular, especially post-pandemic. We all remember the struggle with lockdown and social issues. Therefore, equipping couriers with card terminals was a necessary hardware expense. This ensures seamless transactions and caters to customer preferences, though no specific numerical cost is provided in the data.

Other software. While not explicitly detailed with costs, the text implies broader hardware and software needs for managing operations, tracking, and data. So, you may need systems to make the delivery fleet run efficiently and manage all dispatch and delivery tasks with the shipping process smoothly.

By summing up the quantifiable annual costs for personnel, a single vehicle, and a single parcel locker, we get a comprehensive picture of the expenses involved:

personnel – €11,808

vehicle – €10,850.80

parcel locker – €10,147.87

Overall estimated annual last-mile cost is €32,806.67

Despite the complexities and inherent expenses, the cost of last-mile delivery process can be significantly reduced. A critical step in achieving this is recognizing that many existing technologies and operational approaches are outdated and in urgent need of updating. The traditional models, while effective in their time, simply aren't equipped to handle the demands of today's dynamic eCommerce landscape and customer expectations for speed and transparency.

To drive down costs and improve efficiency, companies must embrace a strategic overhaul of their last-mile operations. This includes:

Invest in advanced route optimization software. Manual or basic route planning leads to wasted fuel. Others involve longer delivery times and increased labor costs. Modern software uses advanced algorithms to calculate the most efficient routes. They take into account real-time traffic, delivery windows, and throughput.

Implement telematics and IoT for fleet management. Real-time data from vehicles allows for proactive maintenance. What's more, they influence better driver behavior and fuel savings, which directly translates into vehicle operating costs.

Expanding and optimizing the shipment network. As highlighted in the cost statement, parcel machines can reduce the need for expensive door-to-door deliveries. Strategic placement and increased capacity of these lockers can further reduce costs per parcel.

Upgrade to efficient payment and tracking systems. Outdated payment terminals and tracking methods create bottlenecks and generate administrative costs. Investing in modern, integrated hardware and software for seamless transactions and real-time shipment tracking increases operational fluidity and customer satisfaction.

Adexin's guide to drive last-mile delivery

The escalating demand for online shopping will drive a 36% increase in delivery vehicles across the top 100 global cities by 2030. This surge is expected to result in a 32% rise in delivery traffic emissions and over 21% more congestion, adding an average of 11 minutes to daily commute times.

However, proactive interventions could significantly mitigate these impacts, potentially reducing CO2 emissions and congestion by 30% each and cutting delivery costs by 25% by 2030, compared to a "do nothing" approach. We also outline a high-level timeline showcasing interventions that could be effective within the next few years.

1. Advanced vehicle and driver workflow optimization

Intelligent driver support system (IDSS), such as custom mobile and in-vehicle applications featuring:

Camera-based object tracking integration. Software modules interface with vehicle cameras for real-time object detection and recognition, aiding parking, navigation, and proof of delivery.

Machine learning aided dispatch and guidance. Algorithms for predictive routing, dynamic delivery process, and re-routing based on real-time conditions, and intelligent task allocation.

Automated vehicle loading system. Software components to integrate with robotic or automated loading systems for efficient parcel staging and vehicle packing.

Advanced analytics-based driver apps. Intuitive dashboards and tools provide drivers with optimized routes, real-time traffic updates, delivery manifests, customer communication capabilities, and performance metrics.

Delivery fleet electrification and efficiency management modules:

EV fleet management and charging optimization. Software to monitor electric vehicle (EV) battery status, plan optimal charging schedules, identify available charging stations, and track energy consumption for proprietary (e.g., StreetScooter-like vehicles) and third-party EVs.

Drivetrain performance analytics. Custom analytics tools to monitor the efficiency of conventional and electric/fuel cell drivetrains, identifying operational improvement and maintenance areas.

2. Smart distribution and hub automation platforms

Our software enhances the efficiency and autonomy of your distribution centers. Let's look at an autonomous material handling and parcel management systems:

Robotics process automation integration. Modules to orchestrate autonomous robots and automated sorting systems for parcel intake, storage, retrieval, and outbound staging.

Self-learning app frameworks. ML-driven software optimizes delivery routes and internal logistics processes based on throughput data, while keeping maintenance costs low. All that to reduce physical storage space and inventory levels, and discover more demand patterns.

Inventory and throughput optimization engines. Algorithms to minimize dwell times are used to optimize storage density. This major last-mile delivery problem can be solved with narrow tracking of customer queries that ensure rapid parcel flow from inbound to outbound.

3. Urban logistics and consolidation management systems

We build the software infrastructure to facilitate efficient urban delivery networks. Consolidated PUDO (pickup and drop-off) network management:

Parcel locker management systems. Custom software for managing inventory, availability, and user access for manned parcel shops and unmanned locker concepts. This includes API integrations for carrier-agnostic service structures.

Mobile and autonomous parcel robot orchestration. Software for dispatching, tracking, and managing a delivery fleet of mobile, autonomously operating parcel delivery robots. All included are path planning and obstacle avoidance algorithms suitable for urban environments.

By partnering with us at Adexin for custom software development, you're not just buying a product. I can clearly say that you're investing in a tailored digital transformation that delivers tangible results. So to speak, you can reduce congestion, get lower emissions, and reduce delivery costs. We're standing at the superiority of your last-mile experience for your customers. We build the future of last-mile delivery operations, specifically for your business.

Adexin develops and deploys modular, integrated software platforms tailored to revolutionize your last-mile operations. Our custom solutions leverage cutting-edge technologies to deliver precision, sustainability, and significant cost reductions.

Let's see our next solutions:

eProcurement solution for educational resources case study

Since 2022, our ongoing collaboration with ITS Astra in Germany has focused on transforming educational procurement with an advanced procurement management system.

We have developed an advanced Excel-to-Web platform that streamlines the procurement of school resources, eliminating manual processes and paper. The solution allows teachers to easily manage resource lists, principals to control budgets with clicks, and procurement managers to quickly process hundreds of items.

The system significantly reduces paper consumption, automates workflow, and provides transparent analytics, helping ITS Astra scale transactions without sacrificing quality.

Truck owners' assistance app case study

Since 2018, we have been developing a comprehensive mobile app for truck drivers and trucking companies in the United States, focusing on streamlining critical business processes in the transportation and logistics industry.

Our main challenge was to improve the quality of document scans performed by truck drivers on their mobile devices, as poor quality scans often led to payment delays. We addressed this problem by researching and implementing custom software and open source libraries that incorporate features such as automatic document and edge detection, cropping, perspective transformation, and contrast adjustment.

This ongoing digital transformation project leverages C#, .NET, Xamarin, JavaScript, jQuery, and AWS to provide a robust solution for freight tracking. We also supported freight contract management and payment process optimization.

Risks and guarantees of last-mail delivery software solutions

Our custom software development transforms these challenges into strategic advantages. By deploying a modular, integrated platform that optimizes every facet of your last-mile operations from intelligent driver support and automated distribution centers to dynamic route optimization, Adexin offers a clear path to significant improvements.

Your company grows seamlessly, expanding reach and capacity without the daily firefighting of logistical bottlenecks. Focus on strategy, not operational chaos. This isn't a distant dream. It's the reality we've already delivered in real projects for companies like our customers.

What can go wrong otherwise:

Unchecked cost escalation. Without optimized routing and efficient vehicle management, your last-mile delivery costs, already representing over 50% of total shipping costs expenses and globally amounting to €70 billion annually, will continue to balloon.

Wasted investment in fixed assets. Whether conventional or partially electrified, your current fleet will operate far below its potential. The significant investment in vehicles (averaging €10,850.80 annually per unit) and even parcel lockers (€10,147.87 per machine annually).

Losing massive savings. By 2030, you will miss out on the potential for a 25% reduction in delivery costs that proactive interventions can achieve.

Finale takeaway

The rising tide of eCommerce calls for a radical transformation in last-mile delivery, not only in 2025, but also many years ahead. The familiar issue is already more complicated and involves significant labor, vehicle, and infrastructure costs. More than anticipated in many forecasts, traffic and emissions growth, and reliance on outdated methods are no longer sustainable.

Proactive software solutions, such as those developed by Adexin, offer a critical path to mitigating these challenges. We don't make promises of significant reductions in both operating costs and environmental impact. We provide that. With intelligent automation, advanced analytics, and integrated management platforms, companies can move beyond logistics bottlenecks and unlock unprecedented efficiencies. It's not just about optimizing delivery process, it's about building a resilient, sustainable, and profitable future for the entire supply chain.

Ready to transform your last-mile operations and ecommerce logistics? Let's discuss your logistics processes. We'll draft a technical approach and timeline tailored to your unique needs. Partner with Adexin and build the future of your last-mile delivery process, specifically for your business.

Are you in search of a reliable tech partner?

Adexin can help with advanced logistics solutions

Contact us